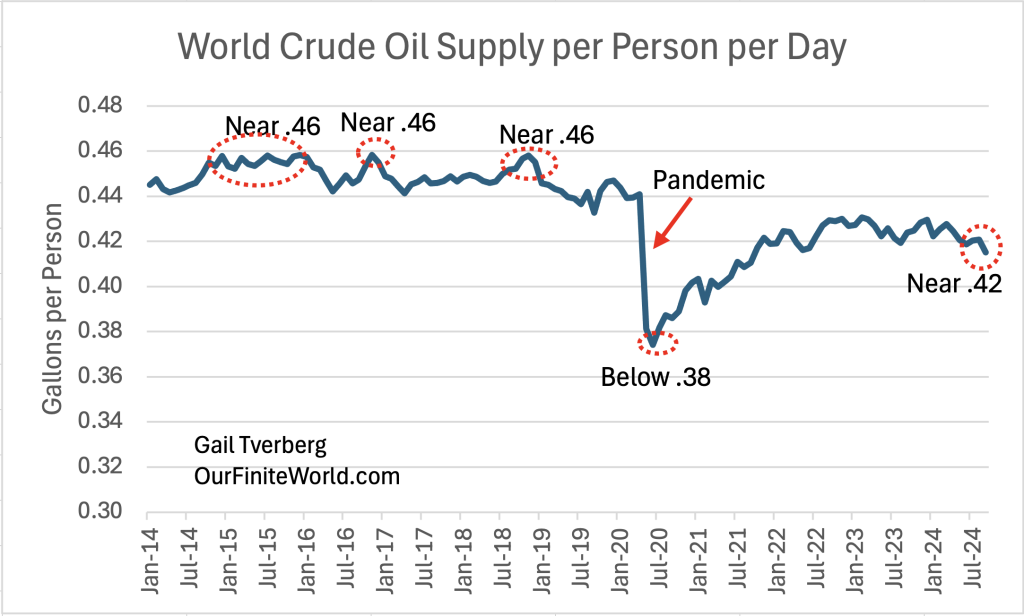

Because the world enters 2025, the essential concern we face is Peak Crude Oil, relative to inhabitants. Crude oil has fallen from as a lot as .46 gallons per individual, which was fairly widespread earlier than the pandemic, to shut to .42 gallons per individual not too long ago (Determine 1).

Individuals have a misimpression relating to how world peak oil may be anticipated to behave. The world economic system has continued to develop, however now it’s starting to maneuver within the course of contraction resulting from an insufficient provide of crude oil. In truth, it’s not simply an insufficient crude oil provide, but additionally an insufficient provide of coal (per individual) and an insufficient provide of uranium.

We all know that when a ship modifications course, this causes turbulence within the water. That is just like the issues we’re at present seeing on the planet economic system. Physics dictates that the economic system must shrink in dimension to match its vitality assets, however no nation needs to be part of this shrinkage. This not directly results in main modifications in elected management and to elevated curiosity in war-like conduct. Unusually sufficient, it additionally appears to result in increased long-term rates of interest, as nicely.

On this put up, I share a number of ideas on what may lie forward for us in 2025, within the mild of the hidden insufficient world vitality provide. I’m predicting main turbulence, however not that issues crumble utterly. Inventory markets will are likely to do poorly; rates of interest will stay excessive; oil and different vitality costs will keep round present ranges, or fall.

[1] I anticipate that the final pattern in 2025 might be towards world recession.

With much less oil (and coal and uranium) relative to inhabitants, the world may be anticipated to provide fewer items and companies per individual. In some sense, folks will typically grow to be poorer. For instance, fewer folks will have the ability to afford new vehicles or new properties.

This pattern towards decrease purchasing-power tends to be concentrated in sure teams similar to younger folks, farmers, and up to date immigrants. In consequence, older people who find themselves well-off or firmly established could possibly largely ignore this concern.

Whereas the shift towards a poorer world has partially been hidden, it has been an enormous consider permitting Donald Trump to be voted again into energy. Main shifts in management are going down elsewhere, as nicely, as an growing share of residents grow to be sad with the present state of affairs.

[2] Many governments will attempt to disguise recessionary tendencies by issuing extra debt to stimulate their economies.

Prior to now, including debt was discovered to be efficient means of stimulating the world economic system as a result of vitality provides supporting the world economic system weren’t significantly constrained. It was doable so as to add new vitality provides, fairly inexpensively. The mixture of extra cheap vitality provides and extra “demand” (offered by the added debt) allowed the full amount of products and companies produced to be elevated. As soon as vitality provides began to grow to be significantly constrained (about 2023), this method began to work far much less nicely. If vitality manufacturing is constrained, the probably impression of added debt might be added inflation.

The issue is that if added authorities debt doesn’t actually add cheap vitality, it would as an alternative create extra buying energy relative to the identical quantity, or a smaller quantity, of completed items and companies obtainable. I consider that in 2025, we’re heading right into a state of affairs the place ramping up governmental debt will largely result in inflation in the price of completed items and companies.

[3] Power costs are prone to stay too low for fossil gas and uranium producers to lift investments from their present low ranges.

Recession and low costs are likely to go collectively. Whereas there could also be occasional spikes in oil and different vitality costs, 2025 is prone to convey oil and different vitality costs which can be, on common, no increased than these of 2024, adjusted for the general improve in costs resulting from inflation. With typically low costs, producers will reduce on new funding. It will trigger manufacturing to fall additional.

[4] I anticipate “gluts” of many energy-related objects in 2025.

Gluts are associated to recession and low costs for producers. The underlying drawback is {that a} important share of the inhabitants finds that completed items, made with vitality merchandise and funding at present rates of interest, are too costly to purchase.

Even farmers are affected by low costs, simply as they have been again on the time of the Nice Melancholy. We are able to consider meals as an vitality product that’s eaten by folks. Farmers discover that their return on farm funding is simply too low, and that their implied wages are low. Low earnings for farmers world wide feeds again by way of the system as low shopping for energy for new farm gear, and for getting items and companies on the whole.

In 2025, I anticipate there might be a glut of crude oil resulting from a scarcity of buying energy of many poor folks world wide. My forecast is just like the forecast of the IEA that predicts an oversupply of oil in 2025. Additionally, a December 2024 article in mining.com says, “A glut of coal in China is ready to push falling costs even decrease.”

Even wind generators and photo voltaic panels can attain an oversupply level. In response to one article, variety of Chine photo voltaic panel builders appears to be far too excessive for world demand, resulting in a possible shake out. Because the share of wind and solar energy added to the electrical grid will increase, the frequency of low or unfavorable fee for wholesale electrical energy will increase. This makes including extra wind generators and photo voltaic panels problematic, after a sure level. We don’t but have an economical means of storing intermittent electrical energy for months on finish. This appears to be a part of the explanation why there not too long ago have been no bidders for producing extra offshore wind energy in Denmark.

[5] I anticipate long-term rates of interest to stay excessive. This might be an issue for brand spanking new investments of all types and for governmental borrowing.

In Part 2 of this put up, I attempted to clarify {that a} peak-oil impression is prone to be inflation. This happens as a result of ramping up debt to attempt to stimulate the economic system now not works to get extra low-cost vitality merchandise from the bottom. As a substitute of getting as many completed items and companies as hoped for, the added debt tends to provide inflation as an alternative.

I consider that we’re reaching a stage of fossil-fuel depletion the place it’s turning into more and more tough to ramp up manufacturing, even with added funding. Due to the added debt added in an try to work round depletion, inflation within the worth of completed items and companies may be anticipated. Traders are starting to see long-term inflation as a probable drawback. In consequence, they’re beginning to demand increased long-term rates of interest to compensate for the anticipated lower in shopping for energy.

Determine 2 reveals that US long-term rates of interest have different broadly. There was a interval of typically dropping long-term rates of interest from 1981 to 2020. Beginning in late 2020, rates of interest started to rise; in 2023 and 2024 they’ve been within the 4% to five% vary. These comparatively excessive charges are occurring as a result of lenders are demanding increased long-term rates of interest in response to increased inflation charges.

Due to inflationary pressures, I anticipate that long-term rates of interest will have a tendency to remain at immediately’s excessive degree in 2025; they could even rise additional. These continued excessive rates of interest will grow to be an issue for a lot of households wanting to buy a house as a result of US house mortgage charges rise and fall with US 10-year rates of interest. Usually households are confronted with each excessive house costs and excessive rates of interest. This mixture makes mortgage prices an issue for a lot of households.

Governments are additionally adversely affected. They have a tendency to carry giant quantities of debt that they’ve accrued over a interval or years. Up till 2020, a lot of this added debt typically was at a really low rate of interest. As extra long-term debt at increased rates of interest is added, annual rate of interest funds are likely to rise quickly. This may trigger a necessity to lift taxes. Japan, particularly, could be affected by increased rates of interest due to its excessive degree of presidency debt, relative to GDP.

Greater rates of interest may even increase prices for residents making an attempt to finance the acquisition of properties, and for buyers wanting to construct wind generators or photo voltaic panels. In truth, funding in any sort of manufacturing unit, pipelines, or electrical energy transmission will are likely to grow to be dearer.

In a way, we appear to be seeing the height oil drawback shifting in a means that impacts rates of interest and the economic system on the whole. Both increased rates of interest or increased oil costs will are likely to push the economic system towards recession. We are likely to search for rising costs to sign an oil provide drawback, however maybe that solely works when there may be extreme demand. If the issue is actually insufficient oil provide, maybe we must always search for increased long-term rates of interest, as an alternative.

[6] Business world wide is prone to be hit particularly exhausting by recessionary tendencies.

Business requires funding. Greater rates of interest make new industrial funding dearer. Business can be a heavy consumer of vitality merchandise. Placing these observations collectively, it shouldn’t come as a shock if new industrial funding is without doubt one of the first locations to be reduce due to peak oil provide.

The unique 1972 Limits to Progress evaluation, in its base mannequin, urged that assets would begin to run brief about now. The variables on this mannequin have been not too long ago recalibrated within the article, “Recalibration of limits to progress: An replace of the World3 mannequin.” Based mostly on the detailed knowledge given within the endnotes to the article, I calculated the anticipated industrialization per capita proven in Determine 3.

Based mostly on Determine 3, this mannequin reveals that industrialization per individual reached a peak in 2017. Peak industrialization (whole, not per capita) occurred in 2018, which coincides with peak crude oil extraction (not per capita).

The mannequin appears to counsel that after an inflection level in 2023 (that’s 2024 and after), industrialization will begin to fall extra steeply. The mannequin reveals a lower in manufacturing per capita of 4.1% in 2024 and of 5.3% in 2025. Such decreases would push the world economic system towards recession.

The mannequin suggests that folks, on common, are getting poorer by way of the amount of products and companies they’ll afford to purchase. New vehicles, bikes, and houses have gotten much less inexpensive. Closely industrialized international locations, similar to China, South Korea, and Germany are prone to be particularly affected by headwinds to industrialization. I anticipate that the financial issues in these international locations will proceed and are prone to worsen in 2025.

[7] The US has tried to isolate itself from this practically worldwide recession. I anticipate that in 2025, the US will more and more slip into recession, as nicely.

There are a number of causes for this perception:

(a) The US is closely dependent upon imports of uncooked materials. China is limiting exports of essential minerals utilized by the US. It will make it very tough or inconceivable to ramp up excessive tech industries as deliberate.

(b) The US is closely depending on Russia for provides of enriched uranium. Any plan for added nuclear electrical energy wants to contemplate the place the uranium to energy these vegetation will come from. It additionally wants to contemplate how this uranium might be enriched to the required focus of uranium-235.

(c) If the US can ramp up crude oil and pure gasoline manufacturing, this will maybe counter this pattern towards US and world recession. Sadly, latest US oil provide has not been ramping up; as an alternative its manufacturing has been pretty flat. Pure gasoline manufacturing has really been decrease since February 2024. Plans have been made to quickly ramp up US liquefied pure gasoline (LNG) exports, however these plans can not work if the US pure gasoline provide is already reducing.

(d) The US authorities has had a bonus in borrowing as a result of the US greenback is the world’s reserve forex. As such, the US is, in some sense, the primary borrower, pulling the remainder of the world alongside. The US, by making its brief time period rates of interest increased than these of many different international locations, was in a position to largely escape recession 2023 and 2024. Further funding was drawn to the US by these increased rates of interest. However the US can not observe this technique indefinitely. For one factor, a excessive US greenback handicaps exports. For one more, curiosity prices on authorities debt grow to be burdensome.

(e) Donald Trump has plans to shut inefficient components of presidency. These modifications, if enacted, will cut back “demand” throughout the economic system as a result of staff in these sectors will lose their jobs. Over the long run, these modifications may be helpful, however over the brief time period, they’re prone to be recessionary.

(f) It’s tough for the US to do significantly better than the remainder of the world. If the remainder of the world is in recession, the US will have a tendency to move in that course, as nicely.

[8] I anticipate extra battle in 2025, however immediately’s wars won’t look very similar to World Battle I or World Battle II.

Right this moment, not many international locations are in a position to construct large fleets of fighter airplanes. Even constructing drones and bombs appears to require provide strains that stretch world wide. So, as an alternative, wars are being fought in non-military methods, similar to with sanctions and tariffs.

I anticipate that this pattern away from direct army battle will proceed, with extra novel approaches similar to web interference and stealth harm to infrastructure going down as an alternative.

I don’t anticipate that nuclear bombs might be used, even when there may be direct battle between highly effective adversaries. For one factor, uranium in these bombs is required for different functions. For one more, there may be an excessive amount of probability of retaliation.

[9] I anticipate many forms of capital good points might be low in 2025.

The state of affairs we face now’s the alternative of the drop in long-term rates of interest noticed between 1981 and 2020, in Determine (2), above. This historic drop in rates of interest made it doable for companies to extra simply finance new investments. It additionally made it doable for particular person residents to have the ability to afford extra properties and vehicles. It shouldn’t be stunning that this era has been a time of rising inventory market costs, particularly in the US.

The world’s financial drawback is that it now not has the tailwind of falling long-term rates of interest. As a substitute, rising long-term rates of interest have gotten a headwind. Residence costs are un-affordably excessive for many potential consumers at immediately’s rates of interest. An identical drawback faces these hoping to buy agricultural gear and farmland at immediately’s excessive costs and excessive rates of interest.

We shouldn’t be shocked if house and farm costs stabilize and start to fall. Costs of shares of inventory are prone to encounter comparable headwinds. Costs of by-product investments could carry out even worse than the shares themselves.

Not too long ago, quite a lot of the energy of the US market has been in a number of shares. Synthetic Intelligence (AI) must in a short time present a whole lot of profit to the inventory market as a complete for this to vary. I can not think about this occurring. With the US slipping towards recession, I anticipate that the US inventory market will at greatest plateau in 2025.

[10] With much less vitality obtainable and better rates of interest on authorities debt, I anticipate to see extra authorities organizations disbanding.

It takes vitality, immediately and not directly, to function any sort of governmental group. Eliminating governmental organizations is a method of saving vitality. That is what occurred when the central authorities of the Soviet Union collapsed in 1991. I’d assume that parallel sorts of modifications might begin occurring within the subsequent few years, in lots of components of the world.

At a while, maybe as quickly as 2025, the European Union might collapse. If issues are going badly for a lot of member international locations, they are going to be much less prepared to help the European Union with their tax revenues. Different organizations that appear like they may very well be in peril embody NATO and the World Commerce Group.

In some methods, such shrinkage could be in parallel with Trump’s plan for eliminating pointless governmental organizations inside the US. All these organizations require vitality; chopping their quantity would go a way towards lowering crude oil and different vitality consumption.

[11] It’s doable that the world economic system will ultimately get itself out of its obvious pattern towards recession, however I’m afraid this can occur lengthy after 2025.

We all know that the world economic system tends to function in cycles. We wish to consider that the obvious present down-cycle is simply non permanent, however we are able to’t know this for positive. Physics tells us that we’d like vitality provides of the proper for any motion that contributes to GDP. Working in need of vitality provides is due to this fact a really worrisome situation.

We additionally know that there are main inefficiencies in present approaches. For instance, oil extraction leaves a lot of the oil useful resource in place. In idea, AI might drastically enhance extraction methods.

We additionally know that uranium consumption is extremely inefficient. M. King Hubbert thought that nuclear vitality utilizing uranium had wonderful potential, however most of this potential stays untapped. Maybe AI might assist on this regard, additionally. If nothing else, maybe recycling spent gas may very well be made cheaper and problematic.

We are able to’t know what lies forward. There could also be a “non secular” ending to our present predicament that we’re discounting that’s really the “proper story.” Or there could also be a “technofix” answer that enables us to avert collapse or disaster. However for now, how the present down-cycle will finish stays a serious trigger for concern.