Abstract: We dwell in a conflict-filled world in the present day. I consider that that is in the end a “not-enough-to-go-around” drawback. Hidden oil shortages are the issue. Surprisingly, at this stage within the financial cycle, oil shortages appear to seem as excessive rates of interest quite than excessive costs. The “local weather is our greatest drawback” narrative will get instructed repeatedly as a result of it makes chopping again on fossil fuels sound like a virtuous factor, quite than one thing we’re being compelled to do.

Introduction: When a serious change happens, resembling shifting to a brand new residence, there are all the time quite a lot of explanations as to why the change happened. When explaining the change to another person, we’ll virtually all the time give a optimistic cause for the transfer, resembling shifting to be nearer to kinfolk, entry to higher job alternatives, or to get pleasure from a greater local weather. We don’t discuss greater than essential about unfavorable points resembling being fired from a job, present process chapter, or contemplating a divorce from one’s partner.

With oil shortages and different vitality issues (together with the opportunity of an excessive amount of fossil fuels resulting in local weather change), the state of affairs is in some methods related. There is no such thing as a easy reply as to why these issues are occurring. What we find yourself with is totally different teams seeing the present state of affairs and its long-term decision from totally different views. Every group emphasizes the facets of the issue that they see as most amenable to being solved. The totally different views result in conflicts among the many teams.

We live in a finite world. It’s not clear that any good options are at hand. What is evident is {that a} finite world behaves very otherwise from what our instinct or the fashions created by economists suggests. On this put up, I’ll attempt present a partial rationalization of what our vitality dilemma entails, and the way this results in battle, even struggle.

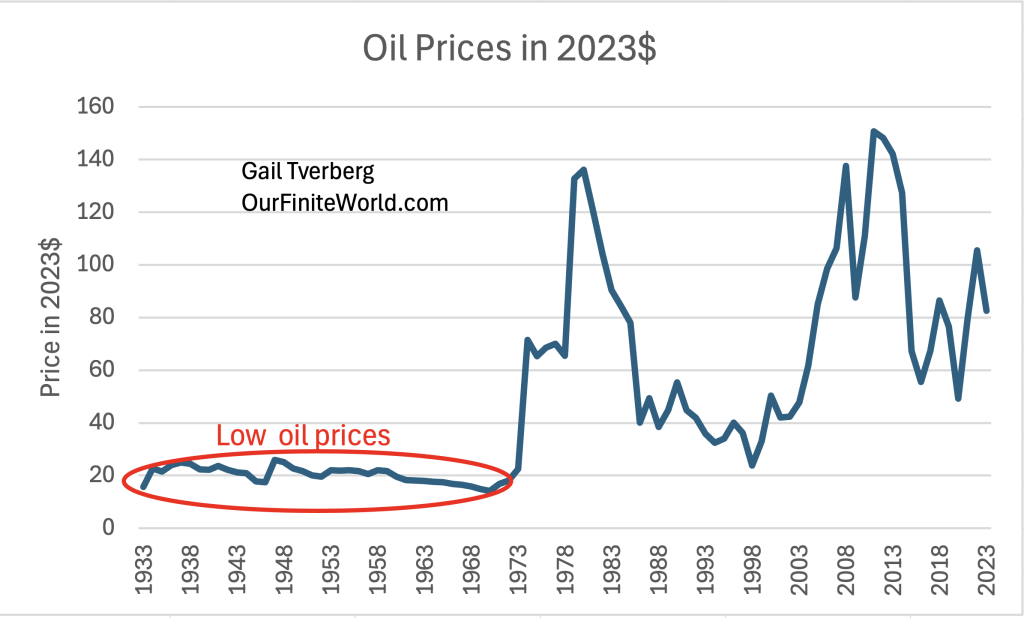

[1] World crude oil provide immediately “turned a nook” about 1973. There was an enormous change each within the worth and progress fee of the oil provide.

Costs have been amazingly low previous to about 1973. The costs proven have been adjusted for inflation to the 2023 worth degree.

As soon as oil costs rose, the expansion fee of oil consumption collapsed as a result of items and providers made with oil have been now not as reasonably priced. There was additionally an effort to chop again on oil consumption as a result of it was clear that low-cost oil provide was restricted.

Will increase within the provide of very low-cost oil allowed many enhancements to infrastructure. Electrical energy transmission traces, interstate highways, lengthy distance oil and gasoline pipelines, and infrastructure supporting transport by air have been all added. The financial system turned extra productive. Determine 3 exhibits that the wages of even low-paid employees have been capable of rise.

Up till 1968, US wages for each the underside 90% of employees and the highest 10% of employees rose a lot quicker than inflation. With this modification, all types of products and providers turned extra reasonably priced, together with meals, new houses, and new vehicles. Within the interval 1968 to 1981, the wages of each teams rose as quick as inflation. After 1981, progress of the wages of the highest 10% far exceeded the inflation fee. Determine 3 exhibits knowledge for the US, however the “Marshall Plan” helped unfold financial progress to Europe, as effectively.

The rising oil costs in 1973 and 1974 introduced the expansion of oil consumption all the way down to a a lot decrease degree. With out low-priced oil, inflation and recession turned rather more of an issue.

[2] Rate of interest adjustments are getting used to offset issues brought on by an excessive amount of or too little oil provide progress.

Determine 4 exhibits that rising rates of interest acted as brakes on the financial system up till 1981. Determine 3 exhibits that this was a interval when the purchasing-power of employees was quickly increasing, not directly due to the rising provide of low-cost oil. The explanation why these greater charges slowed the financial system is as a result of greater rates of interest make it dearer to finance high-cost purchases. These greater rates of interest additionally tended to carry down worth appreciation of property resembling houses and shares of inventory as a result of fewer patrons might afford them.

Decreasing rates of interest over the 4 a long time starting in 1981 acted in the other way. These decrease rates of interest made main purchases extra reasonably priced, permitting extra folks to afford a given residence or farm. This tended to boost residence and farm costs. Within the US, refinancing mortgages at decrease rates of interest and taking out some or the entire worth appreciation on the property turned well-liked, additional including to buying energy. These adjustments acted to spice up the financial system, hiding the rising issues with high-cost oil provide.

[3] The world now appears to be hitting two limits directly: (a) Crude oil provide isn’t maintaining, and (b) Rates of interest are stubbornly excessive.

Determine 5 exhibits that world crude oil manufacturing (relative to inhabitants) was decrease in June 2024 than for any month since June 2022. The June 2024 manufacturing degree was a lot decrease than in 2019, earlier than the drop-off in oil manufacturing associated to Covid-19 restrictions. An extended view strongly means that the height in world oil manufacturing happened in 2019.

Primarily based on the excessive costs skilled within the Seventies, many individuals in the present day assume that insufficient oil provide will probably be signaled by excessive costs. As a substitute, what is going on now could be extra of an affordability drawback. There are extra younger folks with pupil loans who can not afford vehicles or households. There are lots of folks with school levels working at jobs that don’t require superior schooling, and thus don’t pay effectively. There are extra immigrants incomes low wages. Due to these elements, general demand tends to remain too low to encourage the event of recent, extra marginally worthwhile, oil wells.

Rates of interest proven in Determine 4 have risen sharply since 2020. Governments in lots of international locations have raised debt ranges, however this added debt has not resulted in a corresponding quantity of products and providers being added. The issue is that the oil provide wanted to provide these items and providers isn’t rising sufficiently. As a substitute, the added debt has tended to provide inflation.

Presently, politicians all over the world wish to add new applications (financed by debt) to assist their economies out. If this new debt truly will get extra oil out of the bottom (by means of greater oil costs), it might be useful. However, to this point, the extra spending isn’t producing a corresponding quantity of products and providers; as a substitute, inflation is tending to remain quite excessive. It is a signal that limits on inexpensive-to-extract crude oil are being reached. With extra inflation, rates of interest on mortgages will stay stubbornly excessive, and economies will deteriorate.

Governments could wish to scale back long-term rates of interest, however they can not accomplish that with out having the marketplace for these loans disappear. On this a part of the financial cycle, it seems that excessive rates of interest, not directly resulting from insufficient inexpensive-to-extract crude oil provides, act as a brake on the financial system as a substitute of excessive oil costs. This confuses those that expect excessive oil costs to sign insufficient provide!

[4] Residents are usually not being instructed in regards to the scarcity of low-cost crude oil. As a substitute, a local weather change narrative is being emphasised.

Within the Seventies, large spikes in oil costs led to an instantaneous understanding that the world had an oil drawback. However the truth that the financial system has gone on since then, and oil costs are now not up within the stratosphere, has led folks to consider that the scarcity drawback has gone away. Including to this perception is the truth that there appear to be substantial oil assets that may be extracted with present expertise if the value is excessive sufficient.

With a unique mannequin, primarily based on the quantity of fossil fuels that may be obtainable (if costs might rise excessive sufficient, for lengthy sufficient), it’s doable to conclude that if the world continues to extract fossil fuels because it has up to now, this may contribute to rising CO2 ranges. This, in flip, might have an effect on the local weather.

For my part, we’re at present going through a critical scarcity drawback in the present day, not solely with crude oil, but additionally with coal. World coal consumption, relative to inhabitants, has turned down within the interval since 2012.

The issue with coal appears to be just like oil; there appears to be loads of coal within the floor, however costs gained’t rise excessive sufficient, for lengthy sufficient, to permit extraction of the higher-cost coal.

Anybody wanting on the state of affairs, no matter their perspective, would say, “We actually want one thing apart from oil and coal to complement our present vitality provide.” The query turns into, “How can this situation be framed to be reasonably acceptable to the general public?” President Jimmy Carter, again in 1977, talked in regards to the vitality disaster and the necessity to use much less oil, however he was not re-elected. Residents didn’t like the thought of adjusting their life.

By some means, the plan was developed to border the issue as a local weather change drawback. This method had a number of benefits:

(a) This method would maybe result in discovering some options to grease and coal.

(b) Residents would be capable of really feel virtuous, as they voluntarily endured greater costs and decrease vitality provides, throughout the hoped-for transition.

(c) This method would permit large funding alternatives for companies, together with oil and gasoline firms. Larger earnings would maybe comply with. Universities would additionally profit.

(d) The financial system would present greater GDP due to the rising debt used to finance the so-called renewables. Job alternatives would develop.

(e) Framing the dialog by way of a local weather change narrative as a substitute of the crude oil scarcity narrative conveniently leaves out the significance of very low vitality costs for the affordability of completed items. This narrative additionally leaves out the significance of an satisfactory whole amount of vitality merchandise to keep up GDP progress. Economists didn’t perceive both of those points.

(f) When the carbon emissions objectives have been introduced within the Kyoto Protocol in 1997, the objectives had the oblique impact of shifting trade from the US and Europe to China and different Asian international locations. Due to using very cheap coal and low-cost labor, the shift would permit for the world manufacturing of manufactured items to develop at very low price. Companies within the US and Europe might hopefully reap the benefits of this shift as a result of US and European oil and coal provides have been changing into depleted, making it unattainable to make this modification with out the help of coal provides from China and elsewhere.

[5] The world financial system is already going through a not-enough-to-go-around drawback that performs out in some ways. These not-enough-to-go-around points contribute to battle.

(a) Exporters are usually not getting excessive sufficient costs for his or her exported oil. Income from oil is used each to assist the event of recent fields and to offer tax income for governments to offer providers for his or her residents. If oil costs have been $100 to $150 per barrel, exporters would have the extra income wanted to assist their economies. It is a main cause why Russia and Center Japanese international locations are in turmoil.

We don’t consider low oil costs as a not-enough-to-go-around situation, however it’s. Shortages of fossil fuels of any sort are likely to sluggish the expansion within the provide of completed items and providers that use these merchandise. The a part of the world financial system left behind could be the producers of fossil fuels, much more than the shoppers.

(b) Pure gasoline export costs have tended to be too low. Low pipeline pure gasoline costs to Europe have been a serious cause why Russia wished to shift its pure gasoline exports towards China and different Asian international locations, the place costs is likely to be greater. US pure gasoline producers are additionally sad in regards to the low costs they get. The US can be joyful to push Russia out as a pure gasoline exporter to Europe.

(c) The Superior Economies have lowered industrialization due to depleting oil and coal provides. They’ve substituted the sale of providers.

The US first shifted away from industrialization in 1974, instantly after it found that its non-shale oil provide was declining, and the value of further oil would should be a lot greater. An additional shift occurred after the 1997 Kyoto Protocol.

On the identical time, the economic manufacturing of the “Apart from Superior Economies” (together with China, Russia, and Iran) has soared. The economic manufacturing of those economies now exceeds that of the Superior Economies (together with the US, most of Europe, Japan, Australia amongst others–outlined as OECD members).

What oil is obtainable is more and more consumed by the “Apart from Superior Economies.”

(d) Consumption of the primary merchandise of crude oil is being squeezed down by unusual momentary financial downturns, particularly within the Superior Economies.

Superior Economies appear to be adversely affected way over much less superior economies, partly as a result of industrialization is important; providers can extra simply be eradicated.

(e) Poor folks of the world are particularly affected by the not-enough-to-go-around phenomenon, whereas rich people and firms amass extra wealth and energy.

It is a physics situation that performs out in some ways. Younger folks, particularly, discover it troublesome to make satisfactory wages to afford a house and household. Even younger individuals who get hold of greater schooling discover it troublesome to succeed.

Main foundations, such because the Invoice and Melinda Gates Basis, achieve energy over what would look like unbiased organizations, such because the World Well being Group, by making large donations. Regulators of many varieties change into tied to the teams they regulate, making choices that favor the businesses that they’re imagined to be regulating over the welfare of the person residents that they’re imagined to be defending.

Within the present state of affairs, most of the people feels more and more powerless, and lots of really feel the urge to take issues into their very own palms. All these items add to the battle state of affairs.

[6] America has been the main world energy, however its potential to defend different international locations militarily is quickly eroding.

Whereas Ukraine, Israel, Taiwan, and members of the EU wish to suppose that the US can adequately defend their pursuits militarily, this potential is quickly eroding. Immediately, practically each sort of producing within the US requires provide traces from all over the world. It’s troublesome to provide wanted navy support to international locations abroad, with out putting an order for provides from a rustic that the US is more and more in battle with.

Even the availability of electrical transformers to switch broken ones in struggle zones raises a query of whether or not a enough provide could be assured to satisfy the demand for replacements for storm-damaged transformers within the US. Lengthy lead occasions are sometimes required to acquire transformers within the US, even within the absence of any further demand for them.

The US tends to make use of sanctions to attempt to get different international locations to do because it prefers. This method doesn’t work effectively as a result of sanctioned international locations study to work across the sanctions. More and more, within the BRICS international locations, steps are being taken to maneuver away from the US greenback as the usual for commerce.

So long as the US is the accepted world chief, different international locations which are concerned in conflicts (that are not directly about vitality provide) will attempt to attract the US in to assist them. Ukraine has been having vitality issues for a really very long time.

The EU, the UK, and Israel all appear to need struggle, and they want the US to assist them.

In 2023, US per-capita oil consumption is greater than double that of the EU, UK, and Israel on the identical date. The US’s whole vitality consumption per-capita is greater than 4 occasions that of Ukraine. These international locations assume that the US can present the weapons and different help they want. However the international locations they’re combating towards know that the US relies upon provide traces that stretch all over the world. Really, the US’s potential to offer assist is sort of restricted. This provides different areas of battle.

[7] The shift to wind and photo voltaic electrical energy isn’t understanding as deliberate.

Whereas the US has added wind and photo voltaic capability, it has not added to the per-capita electrical energy provide. It’s too costly when all the prices are thought of, and it’s typically not obtainable when wanted.

Communities are determining that in the event that they actually need a bigger electrical energy provide (to assist electrical car use or rising synthetic intelligence calls for), they should add one thing apart from wind and photo voltaic. Within the US, this often means added pure gasoline electrical energy technology. There are additionally no less than two plans to reactivate closed nuclear crops within the US.

The EU has not had any higher success at ramping up per-capita electrical energy technology utilizing wind and photo voltaic (Determine 14).

A look at Determine 7 (above) means that industrialization doesn’t actually come from an expanded electrical energy provide. Cheap fossil fuels appear to be the bottom of industrialization, and the world is more and more wanting these.

Whereas approaches for shifting away from fossil fuels, apart from wind and photo voltaic, are being tried, success at an satisfactory scale appears to be distant.

[8] It’s laborious to inform the remainder of the story intimately.

We dwell in a finite world. All elements of the financial system function in cycles. In reality, particular person folks, particular person companies, and particular person governments all have finite lifespans. We now appear to be coming to the tip of an financial cycle. We don’t know exactly how this may finish. We do know, primarily based on historical past, that the downward a part of the cycle will possible take years to resolve.

We as people are hard-wired to want “fortunately ever after” endings to our narratives. Because of this individuals who consider that we’re operating wanting fossil fuels are likely to consider that if we simply attempt a little bit tougher, we will extract extra oil, pure gasoline, and coal. There should be sufficient assets within the floor if we focus our efforts in that route.

However, individuals who consider that local weather change is our greatest drawback appear to suppose that we will transition to utilizing a modest quantity of renewable vitality as a substitute. Sadly, the physics of the state of affairs doesn’t permit issues to play out that manner. Additionally, our so-called renewables are constructed on a base of oil and coal. If we will’t get sufficient oil and coal out, already constructed renewables will cease functioning inside just a few years, and new ones will probably be unattainable to construct.

Practically everybody who does modeling assumes that the long run will probably be similar to the previous. Analysts assume that the financial system can proceed to develop without end. They assume that it’s doable to drag bigger and bigger quantities of assets from the bottom. It’s straightforward to imagine that leaders will look out for one of the best pursuits of all their constituents, and that companies will act ethically. However we now have already begun to see proof that these assumptions don’t essentially maintain. The truth that some folks can see that adjustments are coming, whereas others can not, is a part of the rationale for the present battle.

A significant drawback that the world faces is the truth that whereas governments can print more cash, they’ll’t print extra assets. Thus, damaged provide traces are prone to change into extra frequent. Wars could should be fought in new methods–for instance, taking down different one other nation’s web or electrical grid. Pensions will possible should be reduce vastly, or they could in the end disappear fully.

We don’t understand how this all will finish, however quite a lot of battle of 1 sort or one other appears very possible within the subsequent few years.