World crude oil extraction reached an all-time excessive of 84.6 million barrels per day in late 2018, and manufacturing hasn’t been capable of regain that degree since then.

Oil costs have bounced up and down over the ten-year interval 2014 to 2024 (Figure2).

On this put up, I present that altering oil costs have had various impacts on manufacturing. Not too long ago, decrease costs appear to be related to decrease manufacturing as a result of extraction has change into much less worthwhile for producers. A short lived spike in oil costs does little to boost manufacturing. The view of economists that crude oil extraction can proceed to rise indefinitely as a result of decrease manufacturing results in greater costs, which in flip results in larger manufacturing, is just not true. (Economists additionally consider that substitutes will be useful, however this isn’t a topic I’ll attempt to cowl on this put up.)

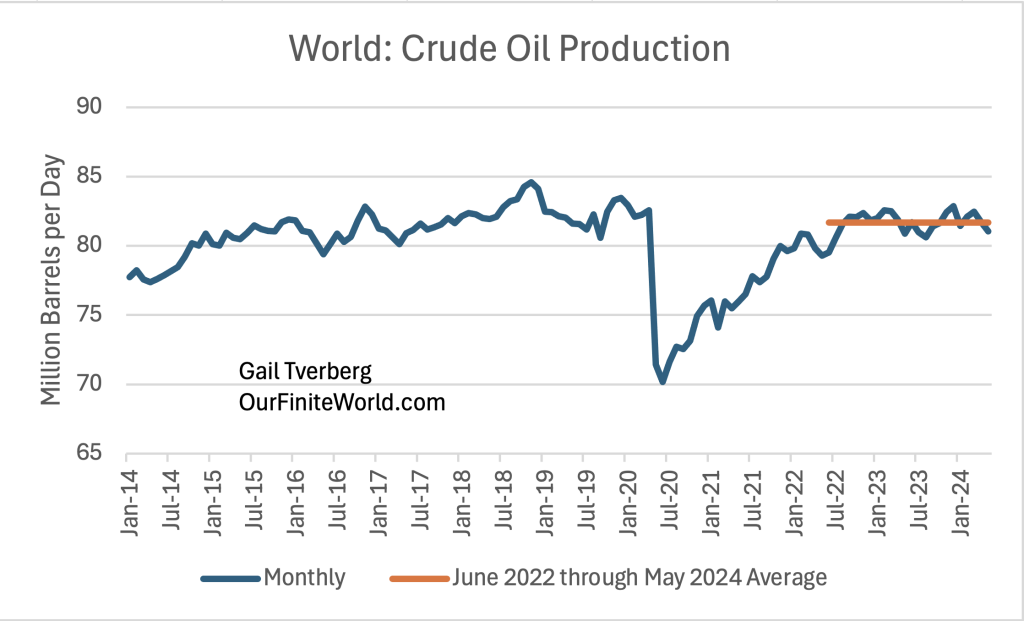

[1] World crude oil manufacturing has not regained its degree previous to the Covid restrictions.

Based on EIA knowledge in Determine 1, the best single month of crude oil manufacturing was November 2018, at 84.6 million barrels per day (mb/d). The best single yr of crude oil manufacturing was 2018, when world crude oil manufacturing averaged 82.9 mb/d. The final 24 months of oil manufacturing have averaged solely 81.7 mb/d of manufacturing. In comparison with the yr with the best common manufacturing, world oil manufacturing is down by 1.2 mb/d.

Moreover, in Determine 1, there may be nothing concerning the world manufacturing path within the final 24 months that gives the look that oil manufacturing shall be surging upward anytime quickly. It merely will increase and reduces barely.

World inhabitants continues to develop. If economists are to be believed, oil costs needs to be taking pictures upward in response to rising demand. Nevertheless, oil costs haven’t usually been growing. The truth is, as of this writing, the Brent crude oil worth stands at $69, which is decrease than the latest common month-to-month worth proven in Determine 2. There may be concern that the US economic system goes into recession, and that this recession will trigger oil costs to fall additional.

[2] OPEC oil manufacturing appears as seemingly as different supply of manufacturing to be influenced by worth, since OPEC sells oil for export and may theoretically reduce simply.

One factor that’s considerably complicated about OPEC’s oil manufacturing is the truth that the membership of OPEC retains altering. The info the EIA shows is the historic manufacturing for the present record of OPEC members. If former members left OPEC due to declining manufacturing, this might be hidden from view.

Based mostly on the EIA’s methodology of displaying historic OPEC oil manufacturing, the height in OPEC manufacturing occurred in November 2016, at 32.9 mb/d. The best yr of oil manufacturing was 2016 at 32.0 mb/d, with 2017 and 2018 virtually as excessive. Common manufacturing over the last 24 months has been 29.2 mb/d, or 2.8 mb/d decrease than the 32.0 mb/d manufacturing in its highest yr. Thus, latest OPEC manufacturing has fallen additional than world manufacturing, relative to their respective highest years. (World manufacturing is down only one.2 mb/d relative to its highest yr.)

[3] An evaluation of OPEC’s manufacturing relative to cost signifies that patterns change over time.

Costs have modified dramatically between 2014 and 2024. I selected to take a look at costs versus manufacturing throughout three totally different time durations, since these durations appear to have very totally different manufacturing progress patterns:

- January 2016 to November 2016 (rising OPEC manufacturing)

- December 2016 to April 2020 (falling OPEC manufacturing)

- Could 2020 to Could 2024 (rising after which falling OPEC manufacturing)

These are the three charts I created:

Throughout this preliminary interval ending November 2016, the decrease the worth of oil, the extra OPEC’s Oil manufacturing elevated. This strategy would make sense if OPEC was attempting to maintain its whole income excessive sufficient to “maintain the lights on.” If another nation (corresponding to america in Determine 7) was flooding the world with oil, and thru its oversupply miserable costs, OPEC didn’t select to reply by reducing its personal manufacturing. As an alternative, it appears to have pumped much more. On this means, OPEC may make sure that US producers weren’t actually getting cash from their newly expanded provide of crude oil. Maybe the US would rapidly reduce–one thing it, in actual fact, did between April 2015 and Nov. 2016, proven in Determine 7 under.

Throughout this second interval ending April 2020, costs plunged to a really low degree, however manufacturing didn’t change considerably. It’s troublesome to vary manufacturing ranges in response to a selected shock as a result of the entire system has been set as much as present a sure degree of oil extraction, and it takes time to make adjustments. Apart from that, costs didn’t appear to have a lot of an influence on manufacturing.

On this third interval ending Could 2024, OPEC producers appear to have been saying, “If the worth isn’t excessive sufficient, we’ll cut back manufacturing.” Determine 6 reveals that with greater costs, the quantity of oil extracted tends to rise, however solely as much as a restrict. When costs quickly hit excessive ranges (in March to August of 2022–the dots over to the proper in Determine 6), manufacturing couldn’t actually rise. The required infrastructure wasn’t in place for a giant ramp up in manufacturing.

Maybe if costs had stayed very excessive, for very lengthy, perhaps manufacturing might need elevated, however that is merely hypothesis. Oil corporations received’t construct loads of extraction infrastructure that they don’t want, no matter what they could announce publicly. I’ve been informed by somebody who labored for Saudi Aramco (in Saudi Arabia) that the corporate has (or at one time had) loads of further house for oil storage, in order that the corporate may quickly ramp up deliveries, as if they’d further productive capability available, however that the corporate didn’t actually have the numerous extra capability that it claimed.

[4] US oil manufacturing since January 2014 has adopted an up and down sample, to a major extent in response to cost.

Determine 7 reveals three distinct humps, with the primary peak in April 2015, the second peak in November 2019, and the third peak in December 2023.

Within the first “hump,” there was an oversupply of oil when the US was attempting to ramp up its home oil provide of oil (via tight oil from shale) on the identical time that OPEC additionally growing manufacturing. The factor that strikes me is that it was OPEC’s oil provide in Iraq that was ramping up and growing OPEC’s oil provide.

The remainder of OPEC had no intention of reducing again if the US was conceited sufficient to imagine that it may increase manufacturing of each US shale and of Iraq with no opposed penalties.

Wanting on the element underlying the primary US hump, oil manufacturing rose between January 2014 and April 2015 when manufacturing was “stopped” by low costs, averaging $54 per barrel in January via March 2015. The US lowered manufacturing, notably of shale, since that was straightforward to chop again, hitting a low level in September 2016. The mix of rising oil provides from each the US and OPEC led to common oil costs of solely $46 per barrel through the three months previous September 2016.

Finally OPEC oil manufacturing peaked in November 2016 (Determine 3), leaving extra “house” out there for US oil manufacturing. Additionally, oil costs have been capable of rise, reaching a peak of $81 per barrel in October 2018. World crude oil manufacturing hit a peak in November 2018 (Determine 1). However even these greater costs have been too low for OPEC producers. They introduced they have been reducing again manufacturing, efficient January 2019, to attempt to additional increase costs.

Through the second hump, US oil manufacturing rose to 12.9 mb/d in November 2019. The oil worth for the three months previous November 2019 was solely $61 per barrel. Evidently, this was not ample to take care of oil manufacturing on the identical degree. The variety of “drilled however uncompleted wells” started to rise quickly.

Drillers selected to not full the wells as a result of the preliminary indications have been that the wells wouldn’t be sufficiently productive. They have been put aside, presumably till costs rise to a excessive sufficient degree to justify the funding.

Determine 7 reveals that the US oil manufacturing had already began to fall earlier than the Covid-related drop in oil manufacturing, which started round April and Could of 2020.

[5] The rise in US oil manufacturing since Could 2020 has been a bumpy one. The height in US oil manufacturing in December 2023 could also be its ultimate peak.

The rise in oil manufacturing since Could 2020 has included the completion of many beforehand drilled however uncompleted (DUC) wells. There was a pattern towards fewer wells, however “longer laterals,” so the sooner wells drilled have been most likely not of the kind most desired extra not too long ago. However these beforehand drilled wells had some benefits. Specifically, the price of drilling them had already been “expensed,” in order that, if this earlier price have been ignored, these wells would offer a greater return to shareholders. If manufacturing was changing into harder, and shareholders needed a greater return on their (most up-to-date) funding, maybe utilizing these earlier drilled wells would work.

There stay a number of points, nonetheless. At present, the variety of DUCs is right down to its 2014 degree. The good thing about already expensed DUCs appears to have disappeared, for the reason that variety of DUSs is now not falling. Additionally, even with the addition of oil from the DUCs, the annual rise in US oil manufacturing has been smaller on this present hump (0.8 mb/d) than within the earlier hump (1.4 mb/d).

Moreover, there are quite a few articles claiming that the greatest shale areas are depleting, or are offering manufacturing profiles which focus extra on pure fuel and pure fuel liquids. Such manufacturing profiles are usually a lot much less worthwhile for producers.

I feel it’s fairly attainable that US crude oil manufacturing will begin a gradual downward decline within the coming yr. It’s even attainable that the December 2023 month-to-month peak won’t ever be surpassed.

[6] Oil costs are to a major extent decided by debt ranges and rates of interest, moderately than what we consider as easy “provide and demand.”

Debt bubbles appear to carry up commodity costs of every kind, together with oil. I’ve mentioned this subject earlier than.

It appears to me that each one the manipulations of debt ranges and rates of interest by central banks are in the end aimed toward maneuvering oil costs into a spread that’s acceptable to each producers of crude oil and purchasers of crude oil, together with the assorted finish merchandise made attainable via the usage of crude oil.

Meals manufacturing is a heavy person of crude oil. If the worth of oil is just too excessive, one attainable end result is that meals costs rise. If this occurs, customers change into sad as a result of their budgets are squeezed. Alternatively, if meals costs don’t rise sufficiently, farmers discover their funds squeezed as a result of they can not get a excessive sufficient return on all the required farming inputs.

[7] The present debt bubble is changing into overstretched.

As we speak’s debt bubble is driving up inventory costs in addition to commodity costs. We will see varied pressures world wide related to this debt bubble. For instance, in China many houses have been constructed in recent times primarily for funding functions, moderately than residential use. This property funding bubble is now collapsing, bringing down property costs and inflicting banks to fail.

As one other instance, Japan is understood for its “carry commerce,” which is made attainable by the mixture of its low rates of interest and better charges in different nations. The Japanese authorities has a really excessive debt degree; it can not stand up to greater than a really low rate of interest. There may be vital concern that this carry commerce will unwind, a problem that has already been worrying world markets.

A 3rd instance pertains to the US, and its function of holder of the US greenback as reserve foreign money, which signifies that the US greenback is used closely in worldwide commerce. Traditionally, the holder of the reserve foreign money has modified about each 100 years, partially as a result of the excessive demand for the reserve foreign money permits the federal government holding the reserve foreign money to borrow at decrease rates of interest than different nations. With these decrease rates of interest, and the necessity to pull the world economic system alongside, there’s a tendency to “spur asset bubbles.” However an asset bubble is prone to have a debt bubble propping it up.

My earlier put up raised the difficulty of the economic system right this moment being uncovered to a debt bubble. There was extreme borrowing in lots of sectors of the economic system which were doing poorly. Business actual property is an instance, as witnessed by many practically empty workplace buildings and buying malls. Individuals with pupil mortgage debt usually delay beginning a household as a result of they’re battling reimbursement of these loans.

If all or any these bubbles ought to burst, there could possibly be a swift downward fall in oil costs and commodity costs, typically. This could possibly be a significant downside as a result of producers would have a tendency to go away the market, and world GDP, which will depend on power provides of the proper varieties, would fall.

[8] Oil is a world commodity. Disruption of demand by any main person may pull costs down for everybody.

China is the only largest importer of oil in right this moment’s world. Its economic system appears to be struggling now. This, by itself, may pull world oil costs down.

[9] We don’t usually take into consideration the truth that oil costs should be each excessive sufficient for producers and low sufficient for customers.

Economists want to suppose that oil costs can rise endlessly, permitting extra oil to be extracted, however historical past reveals that this isn’t what occurs. If there are too many individuals for the out there sources, wage and wealth disparity tends to extend, resulting in many extra very poor folks. A number of opposed issues appear to occur: the holder of the reserve foreign money tends to vary, wars have a tendency to start out, and governments are likely to collapse or be overthrown.

[10] Just because crude oil is within the floor and the expertise appears to be out there to extract the crude oil doesn’t imply that we will essentially ramp up crude oil manufacturing.

One of many main points is getting the worth up excessive sufficient, and lengthy sufficient, for producers to consider that there’s a cheap likelihood of getting cash via a significant new funding. The one time that oil costs have been above $100 for a sustained interval was within the 2011 to 2013 interval. On an inflation-adjusted foundation, costs additionally exceeded $100 per barrel within the 1979 to 1982 interval based mostly on Power Institute knowledge. However we’ve got by no means had a interval through which oil costs exceeded $200 or $300 per barrel, even after accounting for inflation.

The expertise of 2014 and 2015 reveals that even when oil costs rise to excessive ranges, they don’t essentially stay excessive for very lengthy. If a number of components of the world reply with greater oil manufacturing concurrently, costs may crash, as they did in 2014.

There may be additionally a necessity for the general financial system to be out there to help each the extraction of and the persevering with demand for the oil. For instance, a lot of the metal pipe utilized by the US for drilling oil comes from China. Computer systems utilized by engineers fairly often come from China. If China and the US are at odds, there may be prone to be an issue with damaged provide traces. And, as I mentioned in Part 8, disruption of demand affecting even one main importer, corresponding to China, may deliver demand (and costs) down considerably.

[11] Conclusion.

The crude oil scenario is much extra complicated than the fashions of economists make it appear. World crude oil provide appears to be previous peak now; it might be headed down considerably within the subsequent few years. Central banks have been working arduous to maintain oil costs inside an appropriate vary for each producers and customers, however that is changing into more and more inconceivable.

We reside in attention-grabbing occasions!