The fairness markets have collapsed in 2025, the IPO window is closed, the FDA is in turmoil, the NIH is being gutted… and it’s a good time to start out new biotech corporations.

Why? As a result of there are so few being created at this time and there’s far much less competitors for biotech’s startup assets.

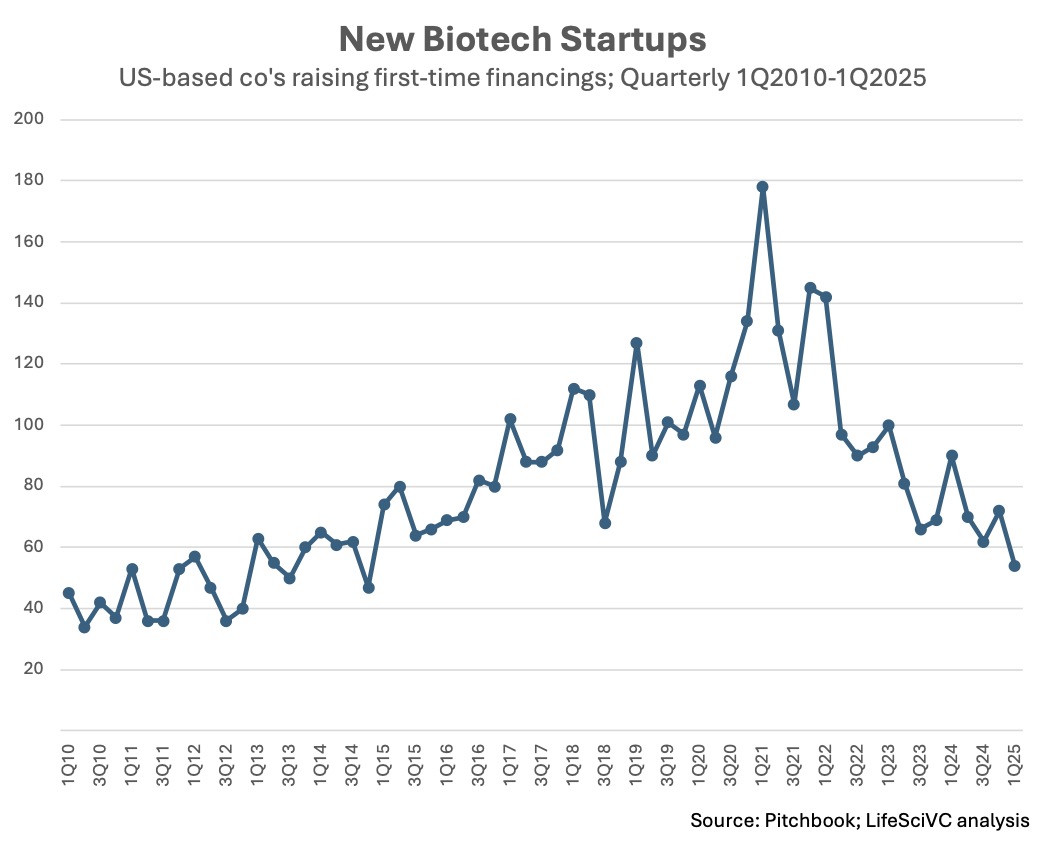

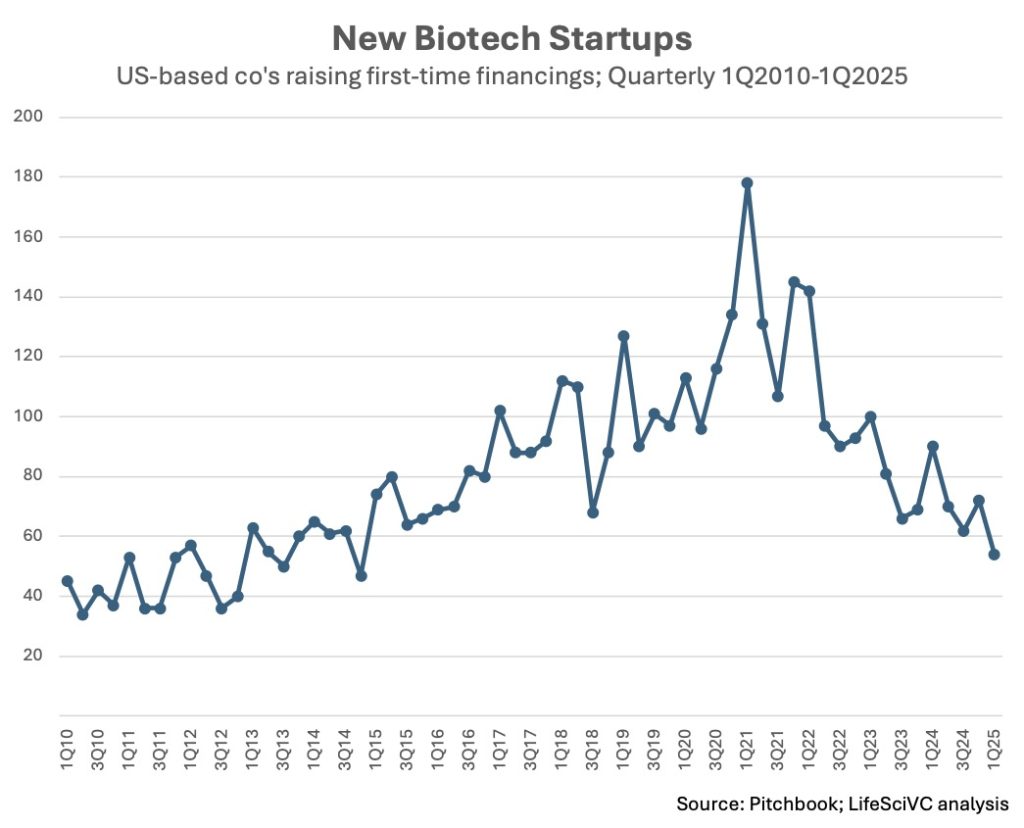

Right here’s a snapshot based mostly on the present lower of Pitchbook knowledge: the 1Q 2025 was the bottom quarterly stage of latest biotech startup formation within the US for a least a decade.

This trendline downwards has been in place for 4 years, because the all-time-high in 1Q 2021 when the $XBI hit it’s peak, and this contraction was the topic of prior blogs in 2023 (Biotech Funding: Instances Are Powerful, Possibly For The Higher) and in 2024 (The Biotech Startup Contraction Continues… And That’s A Good Factor), each of which highlighted the worth of shrinking the pool of VC-backed biotechs. The tempo of latest startup formation is now down almost 70%.

If the ecosystem is dealing with such headwinds, and public buyers particularly are fleeing to safer havens, why will we maintain the contrarian view that now a good time to start out new biotechs? As a result of we’ve been right here earlier than: over the previous twenty years as a enterprise investor, I’ve witnessed a number of funding cycles.

Taking a purely microeconomic viewpoint, startups function in an “biotech fairness” supply-demand atmosphere. When demand to buy new fairness accelerates in frothier markets, tons of provide will get created: over 170 startups acquired their first financings in 1Q 2021. When demand contracts, provide shrinks: because it has over the previous 4 years. However as a provider – which enterprise creation corporations like Atlas are – we’d a lot slightly function in a world of scarce provide as we create our “merchandise”. When everyone seems to be creating startups, hyper-competition for assets, sufferers, and mindshare is a problem. However with scarce startup provide, when investor demand returns, which it is going to (as monetary cycles are endemic to markets), we’ll see worth appreciation: by offering a recent provide of latest fairness possession round promising medicine (with clear cap tables), founding/current fairness holders will likely be rewarded. Paraphrasing an early mentor of mine: as an early stage VC, you’ll want to have a list of rising investments for when the demand a part of the cycle accelerates.

Past fundamental supply-demand economics, the three substances – or “assets” – required for VC-backed biotech startups are all very favorable at this time: science, expertise, and capital.

Scientific substrate for startups is as sturdy and mature as ever. As a sector, over the previous decade we experimented with and developed a broad toolkit of modalities to deal with particular drivers of illness with a variety of therapeutic deliveries. We at the moment are deploying the instruments that work greatest within the context of latest medicines addressing actual unmet wants, by growing degraders, medicine based mostly on covalency and allostery, genetic medicines, or multi-specific engineered biologics, to call a number of. And we’re sourcing this startup substrate from all around the globe (from China to the Cambridges, from Italy to Indianapolis) to create NewCo’s, typically headquartered in our yard biotech communities.

The marketplace for expertise has loosened significantly; nice management and powerful managers are by no means simple to draw and retain, however issues are much more favorable for recruiting groups than again in 2021. Voluntary turnover charges are at decadal lows, and the pool of accessible expertise is deep (and filling with the unlucky RIFs and belt-tightening). Whereas there’s all the time a “battle for expertise” for the most effective groups, the “warmth of fight” has come down significantly on this market.

Personal capital stays considerable by historic measures, even when extra risk-averse at this time, and extra centered on property than platforms. The primary quarter of 2025 noticed greater than $5B in enterprise funding for biotech, and over the previous twelve months there’s been $25B invested. In comparison with the identical annual interval in 2017 and 2018, that is 50% and 25% greater quantities of enterprise funding, respectively. And it’s 300-400% greater than firstly of the secular bull cycles in 2013-2014. Each week there’s a brand new $100M+ mega-round being introduced. So there’s loads of dry powder, despite the fact that it typically seems like corporations are simply sitting on it. Whereas non-public valuations for rising corporations searching for Collection B and later non-public rounds stay difficult, funding rounds are getting performed (although taking longer to shut). And people backlogged non-public corporations ready to go public must weigh the deep reductions of elevating within the non-public markets (and the numerous fairness dilution that suggests) with the choice of promoting/partnering property to strengthen their steadiness sheets. We’ve seen various these offers these days.

Stepping again and these long-term dynamics if you end up within the midst of the bear market a part of the monetary cycle is commonly very tough. And for buyers (and administration groups) who’re being judged on their month-to-month or quarterly returns, it’s brutal. These near-term challenges are to not be taken flippantly as they’ve ripple results and penalties. Redemptions to funds and capitulation to inventory costs raises the price of capital, typically past existential ranges – as we’re seeing within the public markets at this time.

Huge doses of self-discipline are essential drugs for rising corporations to take proper now: specializing in portfolio priorities, tightening budgets and belts, exploring partnership alternate options, contemplating artistic mergers, and so on….

Multi-year contractions just like the one we’re in assist to recalibrate the general variety of biotech corporations. Flux on this ecosystem determines the equilibrium state: startup creation provides to the system, exits and failures subtract. Startup creation is down significantly, and whereas good exits are constrained (IPOs and mergers/acquisitions), failures have accelerated (shutdowns and liquidations/bankruptcies). So the “flux” favors a smaller general ecosystem, although this course of takes years to reset. Likes pigs going by way of the snake, biotechs work their manner by way of the system. After 4 years of this prevailing flux dynamic, the non-public VC-backed ecosystem that is still is far more healthy: the typical well being of the herd goes up with shortage.

However it’s additionally essential to do not forget that nice corporations are sometimes born out of harder instances. Alnylam was began within the nuclear winter of 2002. Nimbus was shaped within the spring of 2009, on the backside of the markets. Kymera was being formulated within the late 2015/early 2016 bear market.

The startups which can be being created at this time – the few and the proud – will possible be the rising stars of 2030’s. It takes years to go from thought to scientific proof of idea in sufferers; except you’re a startup being shaped with current drug candidates, it’s unlikely a de novo discovery startup may have true scientific PoC earlier than the tip of the last decade (solely 5 years away). As an early-stage enterprise investor, a core a part of our job to assist allow these future winners – by creating, funding, constructing and scaling the subsequent technology.