With apologies to Charles Dickens, the marketplace for gene therapies might be summed up as being in “the very best and worst of occasions.”

On the very best aspect, 5 gene remedy builders have raised a mixed $534.4 million in enterprise capital (VC) financing this yr (as of April 14). Tune Therapeutics, a developer of epigenome enhancing therapies, garnered over $175 million in Sequence B funding in January, whereas Atsena Therapeutics earlier this month introduced it had efficiently closed on an oversubscribed $150 million Sequence C financing. Arbor Biotechnologies raised $73.9 million in Sequence C capital, adopted by two Sequence B financings–$68 million raised by epigenetic enhancing remedy developer Epicrispr Biotechnologies and $67.5 million by heart problems gene remedy developer XyloCor Therapeutics.

On the worst aspect, AmplifyBio, a contract analysis group (CRO) and contract growth and manufacturing group (CDMO) specializing in gene in addition to cell therapies, shut down in April after 4 years in enterprise. The corporate mentioned its resolution adopted “months of tireless efforts by the AmplifyBio management workforce, buyers, and different key stakeholders to discover and exhaust all funding and acquisition potentialities.”

AmplifyBio cited a “shortage of investor financing for early-stage biotech firms, which tremendously impacted the flexibility to develop”—not like 2021, when it was launched with $200 million from buyers that included Battelle and Narya Capital, the tech-focused early-stage enterprise capital agency co-founded in 2020 by J.D. Vance.

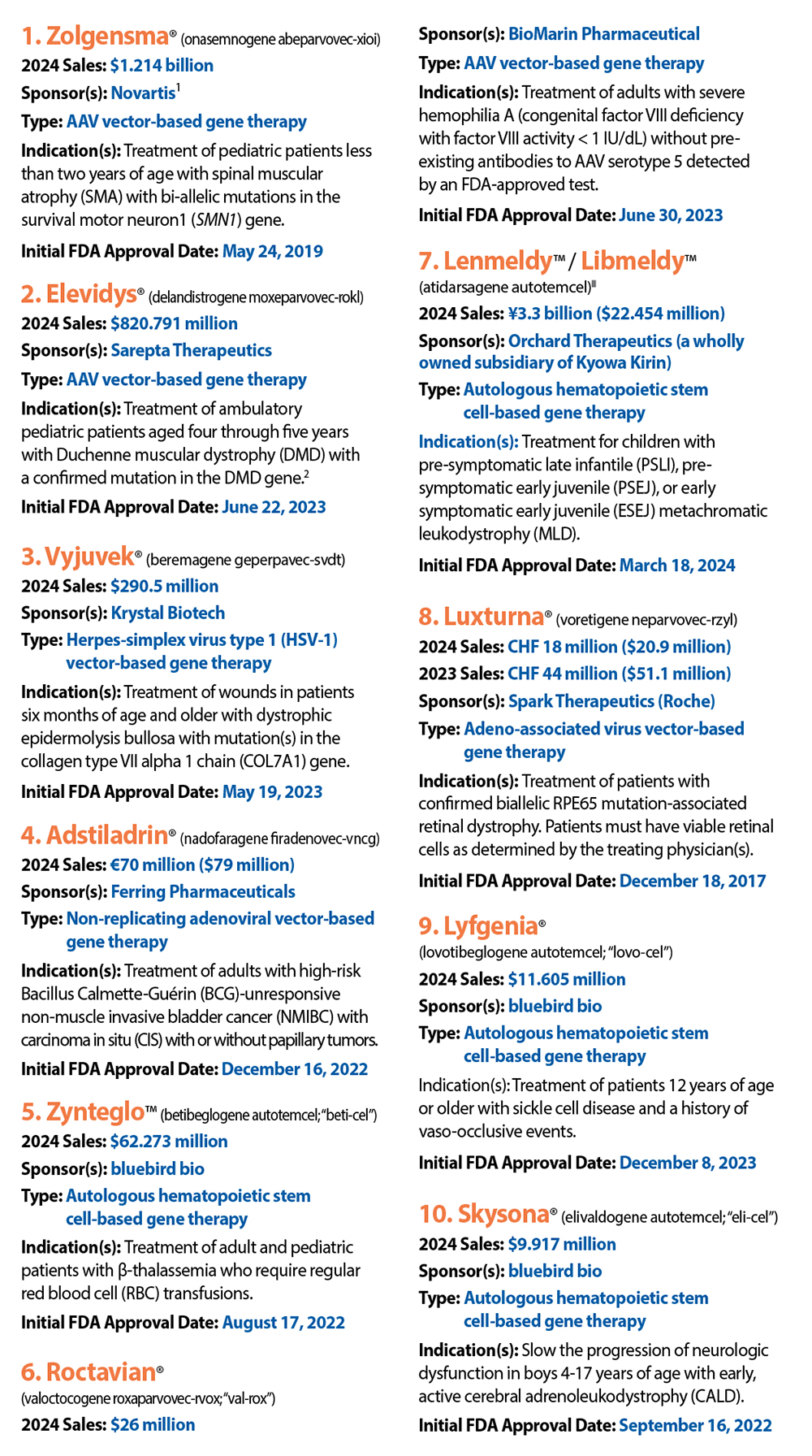

Not like final yr, when GEN included focused T-cell immunotherapies and different cell therapies in what was a broader listing of each cell and gene therapies, this yr the gene remedy area has matured sufficient to have greater than 10 gene alternative therapies with disclosed gross sales figures. In keeping with the American Society of Gene and Cell Remedy (ASGCT), 4 new gene therapies received FDA approval in 2024. Of these, just one had disclosed gross sales excessive sufficient to be included on this A-Record, which ranks top-selling gene therapies primarily based on gross sales and internet product income figures furnished by the businesses in regulatory filings, annual experiences, and/or press releases.

Two therapies with disclosed however low gross sales are excluded: Beqvez™ (fidanacogene elaparvovec-dzkt), superior to approvals in April 2024 by Pfizer and Spark Therapeutics; and Casgevy® (exagamglogene autotemcel; “exa-cel”), the history-making CRISPR-edited remedy co-developed by Vertex Prescription drugs and CRISPR Therapeutics.

Pfizer cited “the restricted curiosity sufferers and their medical doctors have demonstrated in hemophilia gene therapies to this point” as explaining why it has halted growth and commercialization of Beqvez, which generated no gross sales in 2024. Efficient August 6, Pfizer is terminating its license settlement with Spark for Beqvez, an adeno-associated virus (AAV) vector-based gene remedy indicated for types of average to extreme hemophilia B in adults.

Casgevy is an autologous CRISPR genome-edited hematopoietic stem cell-based gene remedy indicated for types of sickle cell illness (SCD) and transfusion-dependent b-thalassemia (TDT). It generated its first income in 2024, $10 million, although its affected person uptake has progressed extra slowly than analysts anticipated.

Additionally not included are gene therapies whose builders haven’t disclosed gross sales, together with:

- BioVex (Amgen)’s Imlygic® (talimogene laherparepvec), a genetically modified oncolytic viral remedy indicated for native remedy of unresectable cutaneous, subcutaneous, and nodal lesions in sufferers with melanoma recurrent after preliminary surgical procedure.

- CSL Behring’s Hemgenix® (etranacogene dezaparvovec), an AAV vector-based gene remedy indicated for adults with Hemophilia B (congenital Issue IX deficiency) who use Issue IX prophylaxis remedy, have present or historic life-threatening hemorrhage, or have repeated critical spontaneous bleeding episodes.

- PTC Therapeutics’ Kebilidi™ (US) / Upstaza™ (ex-US) (eladocagene exuparvovec), an AAV vector-based gene remedy indicated for adults and kids with aromatic12 L-amino acid decarboxylase (AADC) deficiency.

References

1. Novartis is the successor to AveXis, which efficiently accomplished the event of Zolgensma in 2019 by receiving FDA approval for the remedy. In 2014, AveXis licensed from REGENXBIO the AAV9 vector used within the Section I SMA scientific trial at Nationwide Kids’s Hospital. REGENXBIO licensed unique rights to key mental property masking novel recombinant AAV vectors found on the College of Pennsylvania within the lab of James M. Wilson, MD, PhD.

2. Following the sudden loss of life of a affected person with Duchenne muscular dystrophy (DMD) who had been handled with the corporate’s marketed gene remedy, recruitment and dosing had been briefly halted in three scientific research assessing Elevidys on the request of the European Medicines Company: ENVOL (NCT06128564); ENVISION (NCT05881408); and Examine 104 (NCT06241950). On April 4, Sarepta introduced that an impartial knowledge monitoring committee concluded that, primarily based on the totality of proof, the general benefit-risk profile remained favorable to proceed dosing within the paused scientific trials with out adjustments to the examine protocols. Sarepta and Roche agreed to submit the knowledge in response to the short-term halt. A choice by European regulators on resuming the research was pending at deadline.

3. Atidarsagene autotemcel is marketed as Lenmeldy within the U.S. and as Libmeldy inside the European Union.