I predict that the world economic system will shrink within the subsequent 10 years. I feel that that is sure to occur due to power and debt limits the world economic system is hitting. There are a selection of different elements concerned, as properly.

On this publish, I’ll attempt to describe the physics-based limits that the economic system is dealing with, associated to diminishing returns of many varieties. The issue we face has typically been referred to as “limits to development,” or “overshoot and collapse.” Such adjustments are likely to result in a lack of “complexity.” They’re a part of the way in which economies evolve. I might additionally prefer to share some concepts on the adjustments which are more likely to happen over the approaching decade.

[1] The world economic system is a tightly built-in physics-based system, which is experiencing diminishing returns in way more areas than simply oil provide.

When extraction of a mineral takes place, normally the best (and least expensive) portion of the mineral deposit is extracted first. After the most efficient portion is eliminated, the price of extraction step by step will increase. This course of is described as “diminishing returns.” Typically, extra power is required to extract decrease high quality ores.

The economic system is now reaching diminishing returns in some ways. All types of sources are affected, together with fossil fuels, uranium, recent water, copper, lithium, titanium, and different minerals. Even farmland is affected as a result of with greater inhabitants, extra meals is required from an identical quantity of arable land. Extra-cost efforts corresponding to irrigation can improve meals provide from obtainable arable land.

The fundamental downside is two-fold: rising inhabitants takes place whereas the best to extract sources are depleting. The end result appears to be Limits to Development, as modeled within the 1972 guide, “The Limits to Development.” Educational analysis exhibits that issues corresponding to these modeled (typically known as “overshoot and collapse”) have been extraordinarily widespread all through historical past.

Exactly how this downside unfolds varies based on the specifics of every scenario. Rising debt ranges and rising wage disparity are widespread signs earlier than collapse. Governments turn into weak to losses in conflict and to being overthrown from inside. Epidemics are likely to unfold simply as a result of excessive wage disparity results in poor vitamin for a lot of low-wage employees. Dr. Joseph Tainter, in his guide, “The Collapse of Advanced Societies,” describes the scenario because the lack of complexity, as a society not has the flexibility to help among the applications it beforehand was in a position to help.

On the identical time the prevailing economic system is failing, the beginnings of latest economies could be anticipated to begin. In some sense, economies “evolve,” simply as crops and animals evolve. New economies will ultimately exchange current ones. These adjustments are a essential a part of evolution, attributable to the physics of the biosphere.

In physics phrases, economies are dissipative buildings, simply as crops, animals, and hurricanes are dissipative buildings. All dissipative buildings require power provides of some sort(s) to develop and stay away from a lifeless state. These buildings don’t “dwell” endlessly. As a substitute, they arrive to an finish and are sometimes changed by new, barely totally different, dissipative buildings.

[2] Over the following 10 years, the overall course of the economic system will likely be towards contraction, fairly than development.

There are a lot of indications that the world economic system is hitting a turning level due to rising inhabitants and diminishing returns with respect to useful resource extraction. For instance:

[a] Debt ranges are very excessive within the US and different nations. A rising debt degree can briefly be used to drag an economic system ahead with out ample power provides as a result of it not directly provides employees and companies extra spendable revenue. This revenue can be utilized to work across the lack of cheap power merchandise of the popular varieties in quite a lot of other ways:

- It may possibly permit customers to afford a better value for current power merchandise, if the extra funds get again to clients as greater incomes or decrease taxes.

- It may possibly permit companies to seek out extra environment friendly methods of utilizing sources, corresponding to ramping up worldwide commerce or constructing extra environment friendly autos.

- It may possibly permit the event of latest power merchandise, corresponding to nuclear energy era and electrical energy from wind and photo voltaic.

What we’re discovering now could be that these new approaches are likely to encounter bottlenecks of their very own. For instance, oil provide is sufficiently constrained that the present degree of worldwide commerce not appears to be possible. Additionally, wind and photo voltaic don’t straight exchange oil; electrical energy primarily based on wind generators and photo voltaic panels can result in blackouts. Moreover, diminishing returns with respect to grease and different sources tends to worsen over time, resulting in a necessity for ever extra workarounds.

If in some unspecified time in the future, extraction turns into extra constrained and workarounds fail to supply ample aid, added debt will result in inflation fairly than to hoped-for financial development. Increased inflation is the difficulty that many superior economies have been fighting lately. This is a sign that the world has hit limits to development.

[b] Due to low oil costs, corporations are deciding to chop again new investments in extracting oil from shale, and certain elsewhere.

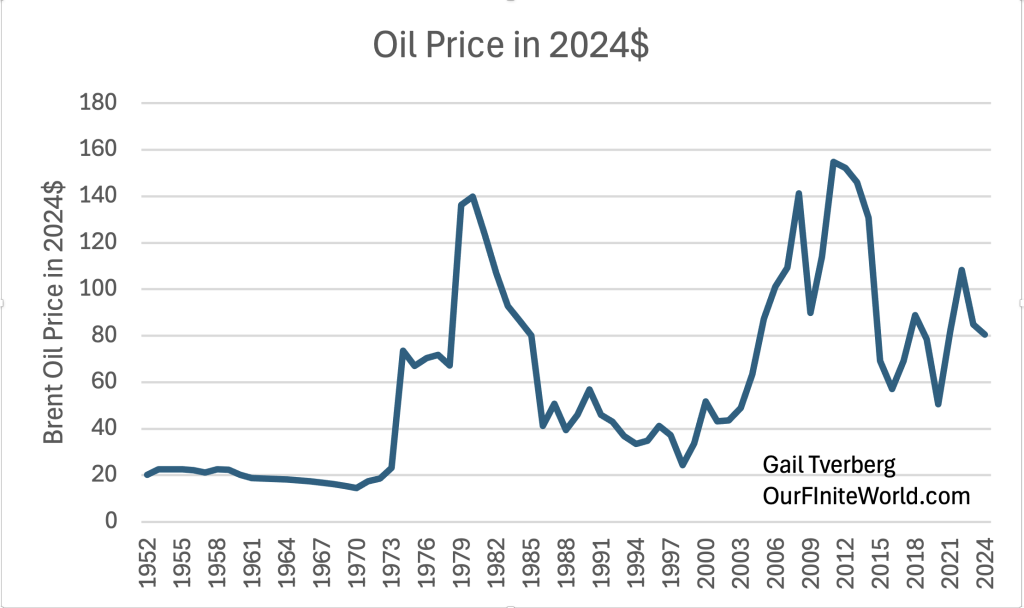

Determine 1 exhibits that oil costs rise and fall; they don’t rise endlessly. They rose after US oil manufacturing hit its first limits in 1970, however this was labored round by ramping up oil manufacturing elsewhere. Costs rose within the 2003 to 2008 interval after which fell briefly because of recession. They returned to a better degree in 2011 to 2013, however they’ve settled at a decrease degree since then.

One issue within the value decline since 2013 has been the manufacturing of US shale oil, including to world oil provide. One other issue has been rising wage disparity, as employees from wealthy nations have not directly begun to compete with employees from low-wage nations for a lot of sorts of jobs. Low-wage employees can not afford vehicles, bikes, or long-distance holidays, and this affordability concern is holding down oil demand.

US oil manufacturing from shale is at risk of collapsing through the subsequent few years as a result of costs are low, making new funding unprofitable for a lot of producers. In reality, present costs for oil from shale are decrease than proven on Determine 1, partly as a result of US costs are a bit of decrease than Brent, and partly as a result of costs have fallen additional in 2025. The latest value obtainable for US WTI oil is just about $62 per barrel.

[c] World per capita coal manufacturing has fallen since 2014. A latest downside has been low costs.

Transportation prices are a significant factor within the delivered value of coal. The diminished manufacturing of coal is a minimum of partly the results of coal mines close to inhabitants facilities getting mined out, and the excessive value of transporting coal from extra distant mines. Right this moment’s coal costs don’t appear to be excessive sufficient to accommodate the upper prices regarding diminishing returns.

[d] In concept, added debt could possibly be used to prop up oil and coal costs, however debt ranges are already very excessive.

Moreover the issue with inflation, talked about in level [a], there are issues with debt ranges changing into unmanageably excessive.

Determine 3 exhibits US authorities debt as a ratio to GDP. If we have a look at the interval since 2008, there was an particularly giant improve in debt on the time of the 2007-2009 Monetary Disaster and the 2020 Pandemic. The debt degree has turn into so excessive that curiosity on the debt is more likely to require tax income to rise endlessly. The underlying downside is needing to pay curiosity on the massive quantity of excellent debt.

Placing collectively [a], [b], [c], and [d], the world has an enormous downside. Because the world economic system is at the moment organized, it’s closely depending on each oil and coal. Oil is closely utilized in agriculture and in transportation of all types (vehicles, vans, trains, airplanes, and ships). Coal is very utilized in metal and concrete making, and in steel refining. We don’t have direct replacements for coal and oil for these makes use of. Wind and photo voltaic are terribly poor at their present state of improvement.

The legal guidelines of physics inform us that, given the world’s present infrastructure, a discount within the availability of each crude oil and coal will result in cutbacks within the manufacturing of many varieties of products and companies all over the world. Thus, we should always anticipate that GDP will contract, maybe for a protracted interval, till workarounds for our difficulties could be developed. Right this moment’s wind generators and photo voltaic panels can not remedy the issue for a lot of causes, considered one of which is that incontrovertible fact that manufacturing and transport of those gadgets depends upon coal and oil provides.

Thus, with out ample oil and coal to satisfy the wants of the world’s rising inhabitants, the world economic system is being compelled to step by step contract.

[3] General dwelling requirements could be anticipated to fall fairly than rise through the subsequent decade.

A latest article within the Economist exhibits the next chart, primarily based on an evaluation by the United Nations:

Determine 4 exhibits the pattern within the Human Growth Index as degree in 2023-24. I anticipate that the pattern will step by step shift downward in 2024-2025 and past. Fashionable advances, corresponding to the supply of potable water in properties and the supply of electrical energy 24 hours per day, will turn into more and more much less widespread.

The Economist article displaying Determine 4 notes that, to this point, a lot of the drop in dwelling requirements has occurred within the poorer nations of the world. These nations had been hit tougher by Covid restrictions than wealthy nations. For instance, the drop in tourism had a better impression on much less superior nations than on wealthy nations. Poor nations had been additionally affected by a decline in export orders for luxurious clothes.

Exterior of poor nations, younger individuals are already discovering it tough to seek out jobs that pay properly. They’re usually burdened with debt regarding superior training, making it tough for them to have the identical lifestyle that their mother and father had. This pattern is more likely to begin hitting older residents, as properly. Jobs will likely be obtainable, however they gained’t pay properly. This downside will have an effect on each younger and previous.

[4] Governments will likely be particularly weak to cutbacks.

Historical past exhibits that when overshoot and collapse happen, governments are more likely to expertise extreme difficulties, not directly as a result of lots of their residents are getting poorer. They require extra authorities applications, but when wages are typically low, the taxes they pay are typically low, too.

Sadly, the sorts of cutbacks being undertaken by the Division of Authorities Effectivity (DOGE) are very a lot essential to get funds by the US authorities all the way down to a degree that may be supported by taxes. No matter how profitable the present DOGE program is, I anticipate an enormous discount within the variety of people on the payroll of the US authorities, maybe by 50% to 75%, within the subsequent 10 years. I additionally anticipate main cutbacks within the funding for out of doors organizations, corresponding to universities and the various organizations DOGE has focused.

In some unspecified time in the future, the US authorities might want to scale back or eradicate many sorts of profit funds made now. One method could be to attempt to ship many sorts of applications, corresponding to job loss safety, Medicaid, and Medicare, again to the states to deal with. After all, the states would even have issue paying for these advantages with out large tax will increase.

[5] Ten years from now, universities and faculties will enroll far fewer college students.

I anticipate that college enrollments will fall by as a lot as 75% over the following 10 years, partly as a result of authorities funding for universities is predicted to fall. With much less funding, tuition and charges are more likely to be even greater than they’re in the present day. On the identical time, jobs for college graduates that pay properly will turn into much less obtainable. These concerns will lead fewer college students to enroll in four-year applications. Shorter, extra focused training educating particular expertise are more likely to turn into extra widespread.

There’ll nonetheless be some high-paying jobs obtainable, requiring college levels. One such space could also be to find solutions to our power and useful resource issues. Such analysis will doubtless be carried out by a smaller variety of researchers than are energetic in the present day as a result of some present areas of analysis will likely be discarded as having too little potential profit relative to the price concerned. Any method thought of might want to succeed with, at most, a tiny quantity of presidency funding.

Excessive paying jobs may be obtainable to a couple college students who plan to be the “wheeler-dealers” of the world. A few of these wheeler-dealer varieties will need to be those founding corporations. Others will need to run for public workplace. They can succeed, as properly. They might need to research specialised tracks to advance their profession targets. Or they could need to select establishments the place they will make contacts with individuals who can assist them in pursuing their profession targets.

For many younger individuals, I anticipate that four-year college levels will more and more be seen as a waste of money and time.

[6] In a shrinking economic system, debt defaults will turn into an rising downside.

A rising economic system could be very useful in permitting monetary establishments to prosper. With development, future earnings of companies are typically greater than previous earnings. These greater earnings make it attainable repay each the borrowed quantity and the required curiosity. With development, there’s no need to put off staff. Thus, the staff have an affordable likelihood to repay mortgage loans and automotive loans based on agreed-upon phrases.

If an economic system is shrinking, overhead turns into an ever-larger share of whole revenues. This makes earnings tougher to realize and will make it essential to put off staff. These laid-off staff usually tend to default on their excellent loans. As debt defaults rise, rates of interest charged by lenders are likely to rise to compensate for the better default threat. The upper rates of interest make debt compensation for future debtors much more tough.

All these points are more likely to result in monetary crises, as debt defaults turn into extra widespread.

[7] As debt defaults rise, banks are likely to fail. This will result in hyperinflation or deflation.

In a shrinking economic system, the massive query when banks fail is, “Will governments bail out the banks?”

If governments bail out the failing banks, there’s a tendency towards inflation as a result of the bailouts improve the cash provide obtainable to residents, however not the amount of products obtainable for buy. If sufficient banks fail, the tendency could also be towards hyperinflation–method an excessive amount of cash obtainable to buy only a few items and companies.

If no authorities bailouts can be found, the tendency is towards deflation. With out bailouts, the issue is that fewer banks can be found to lend to residents and companies. Because of this, fewer individuals can afford to purchase properties and autos utilizing debt, and fewer companies can take out loans to buy wanted provides. These adjustments result in much less demand for completed items. This alteration in demand can not directly be anticipated to have an effect on commodity costs, as properly, together with oil costs. With low costs, some suppliers could exit of enterprise, making any provide downside worse.

No matter whether or not bailouts are tried or not, on common, residents could be anticipated to be getting poorer and poorer as time goes on. This happens as a result of with a shrinking economic system, fewer items and companies will likely be made. Except the inhabitants shrinks on the identical fee, particular person residents will discover themselves getting poorer and poorer.

[8] Anticipate extra tariffs and extra conflicts amongst nations.

With out sufficient oil for transportation, the amount of imported items should be reduce. A tariff is an effective method of doing this. If one nation begins elevating tariffs, the temptation is for different nations to boost tariffs in return. Thus, the general degree of tariffs could be anticipated to rise in future years.

With out sufficient items and companies for everybody to keep up their present lifestyle, there will likely be a particular tendency for extra battle to happen. Nevertheless, I doubt that the end result will likely be World Struggle III. For one factor, the West appears to have insufficient ammunition to struggle a full-scale standard conflict. For an additional, the nuclear bombs which are obtainable are precious for offering gas for our nuclear energy crops. It is mindless to make use of them in conflict.

[9] Anticipate an rising share of empty cabinets, as time goes on.

Excessive tech items are particularly more likely to disappear from cabinets. Alternative elements for vehicles may be tough to seek out, particularly earlier than an aftermarket of domestically manufactured elements seems.

[10] Rates of interest are more likely to keep at their present degree or improve to a better degree.

The excessive degree of borrowing by governments and others makes lenders reluctant to lend except the rates of interest are excessive. It must also be famous that present rates of interest aren’t excessive relative to historic requirements. The world has been spoiled lately with artificially low rates of interest, made attainable by Quantitative Easing and different manipulations.

[11] Clearly, this record will not be exhaustive.

The world economic system has gone by two main disruptions lately, one in 2008, and one in 2020. Very uncommon adjustments corresponding to these are fairly attainable once more.

We don’t know the way quickly new economies will start to evolve. Eric Chaisson, a physicist who has researched this concern, says that there’s a tendency for ever extra complicated, energy-dense programs to evolve over time. This is able to counsel that an much more superior economic system could also be attainable sooner or later.

Word: I’m additionally publishing this publish on Substack. At this level, it’s nonetheless form of an experiment. Feedback typically don’t publish properly on WordPress. It will give readers a special choice for viewing posts. Utilizing Substack, my posts could attain a brand new viewers as properly.

A few of you might obtain an e mail about my Substack publish. I put in some e mail addresses again in January 2024 after I put up a publish on Substack earlier. Subscriptions will proceed to be free each locations. This can be a direct hyperlink to my new publish. https://gailtverberg.substack.com/p/economic-contraction-coming-right