The easy story about determination market liquidity is: such markets want an expectation of liquidity to induce merchants to disclose information there, in order that costs can usefully advise selections. Thus those that worth such recommendation ought to pay for it by subsidizing market maker liquidity.

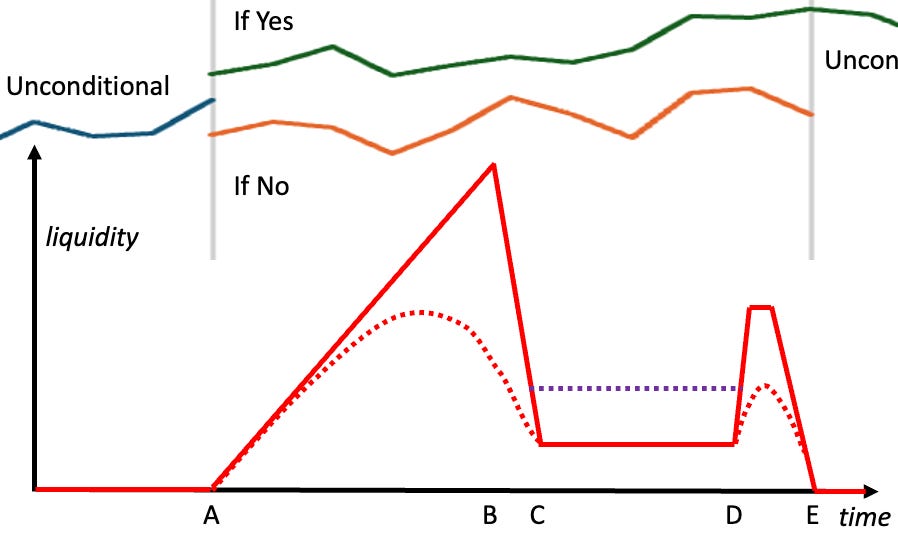

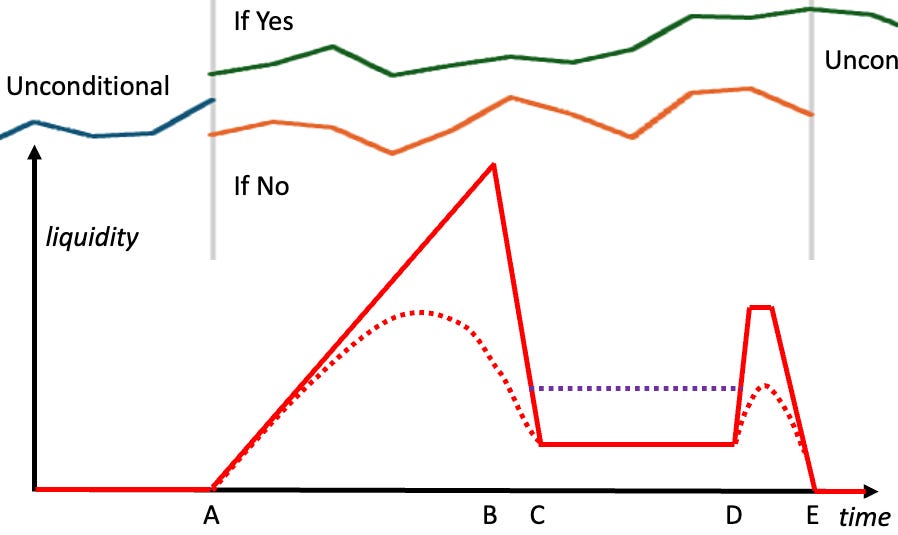

I’ve been considering on this subject for the previous few weeks, and on this submit I’ll give a extra advanced story, tied to this diagram:

On the high of the diagram we see a easy determination market. On the left, on the earliest time, we see in blue the worth of an unconditional market buying and selling money for an asset that pays in proportion to a key determination final result, such because the inventory of a agency or the coin of a DAO.

At time A, two conditional markets are launched, proven in inexperienced and orange, additionally buying and selling this asset for money, however every conditional on some particular proposal being accepted (sure) or rejected (no). At time E the choice is made, based mostly a minimum of partially on worth variations right here between sure and no throughout the A to E interval. At E one of many conditional markets, on this case sure, turns into equal to the unconditional market. The opposite conditional belongings, on this case no, disappear.

In some makes use of of futarchy, there isn’t a want for a no market, as the end result given a no determination is clear. In some makes use of of futarchy, the unconditional market doesn’t exist, as the end result asset solely exists to help this determination. However when an unconditional market exists together with two conditional markets, the three costs suggest a likelihood of the choice being sure. The buying and selling interface can let customers make bets on that likelihood, through trades in these three markets. And that market probability of sure could be useful in the remainder of the system, as we are going to see.

Within the decrease half of the diagram we see a pink line exhibiting a plan for the way conditional market liquidity supplied by backed market makers modifications with time. There is no such thing as a liquidity earlier than A or after E, because the conditional markets don’t exist then. At A, the conditional markets begin, however with poorly knowledgeable preliminary costs created by the market system implementors. The primary merchants thus get to revenue from correcting these first worth errors, however they revenue little as liquidity begins out close to zero.

As there are video games that merchants can play if they’ll anticipate to be the one dealer each earlier than and after a sudden change in liquidity, it appears safer to only keep away from sudden jumps, through have deliberate market maker liquidity be a steady operate of time.

The revenue {that a} dealer makes from altering a worth by delta, from the present worth to their anticipated worth of the asset, is the liquidity instances that worth delta squared (instances the possibility the situation can be met, for conditional markets). Thus including extra liquidity is providing a better worth for information. As determination market sponsors are possible a monopolist purchaser of this information, they don’t need to purchase it at their worth, however as a substitute search a monopolist profit-maximizing worth decrease than their information worth, a worth that trades off getting extra information versus paying extra for that information.

Within the diagram, liquidity will increase steadily from zero at A as much as a most at B. Somebody who is bound that they’re a monopolist vendor of some piece of information ought to thus wait till close to B to disclose their information to the market. However those that anticipate that they’re solely the most cost effective provider of their information ought to fear that the second least expensive provider will promote when the worth rises to that second lowest value. Thus the most cost effective provider ought to promote close to the second least expensive value. A predictably rising liquidity thus induces competitors amongst these with entry to the identical information, permitting the choice market sponsor to purchase that information at a low worth.

The statement interval between C and D is meant to indicate the clearest sign re the worth distinction between the sure and no markets, and thus be the primary focus of determination makers in search of recommendation from these markets. As there are video games that merchants may play on the very finish of the choice interval D, it could be higher to make D a random time, corresponding to through a relentless probability per time of switching modes.

We need to decrease each knowledgeable and manipulative buying and selling throughout this statement interval. Manipulators will deal with that interval as a result of the choice makers will, however as manipulators attempt to appear to be knowledgeable merchants, manipulators are simpler to determine and counter when there’s much less knowledgeable buying and selling. We additionally need to cut back knowledgeable buying and selling on this interval as that may induce a determination choice bias earlier on this interval.

Having a brief statement interval C to D, and a a lot increased backed liquidity each earlier than and after the statement interval, tempts knowledgeable merchants away from the statement interval, This distinction must be large enough to counter the liquidity added by manipulators, proven in a purple dotted line. The liquidity ought to be increased earlier than than after the statement interval to make the choice as knowledgeable as potential. The upper liquidity within the interval D to E earlier than the conditional markets finish additionally makes {that a} good time for merchants to coordinate to exit these markets collectively if there will not be thick unconditional market after E.

Because the sponsor pays to subsidize liquidity in determination markets to assist inform their determination, such information is much less helpful when their determination alternative is extra clear. It could actually thus make sense to cut back liquidity supplied by an element of roughly p(1-p), the place p is the market probability of a sure determination. Such a discount is proven within the diagram as a dotted pink line.

In an advisory futarchy, determination markets can take into account all the worth historical past from A to E, and another information they’ll discover, in making their determination. The standard of the sign within the determination market costs of the interval C to D can be highest if determination makers, or their knowledgeable associates, are allowed to commerce on this interval, if the choice time is obvious, and if the interval from C to E is brief. It could actually additionally make sense to weigh worth variations within the statement interval by p(1-p), as conditional market costs could develop into much less dependable as the possibility of their situation turns into very small.

And there you have got it, a extra detailed evaluation of how finest a choice market sponsor can subsidize market makers to induce merchants to disclose information there.