I’ve mentioned in latest posts that the world financial system is hitting useful resource limits of many sorts. These limits embrace oil, coal, and different sources of vitality, together with uranium, used as a gas for nuclear energy technology. Due to these limits, the world financial system is being compelled to shrink again. For my part, the course it’s headed in is towards smaller, largely less-advanced, extra impartial, economies. This alteration can also be prone to result in varied varieties of monetary collapse for a lot of of as we speak’s Superior Economies.

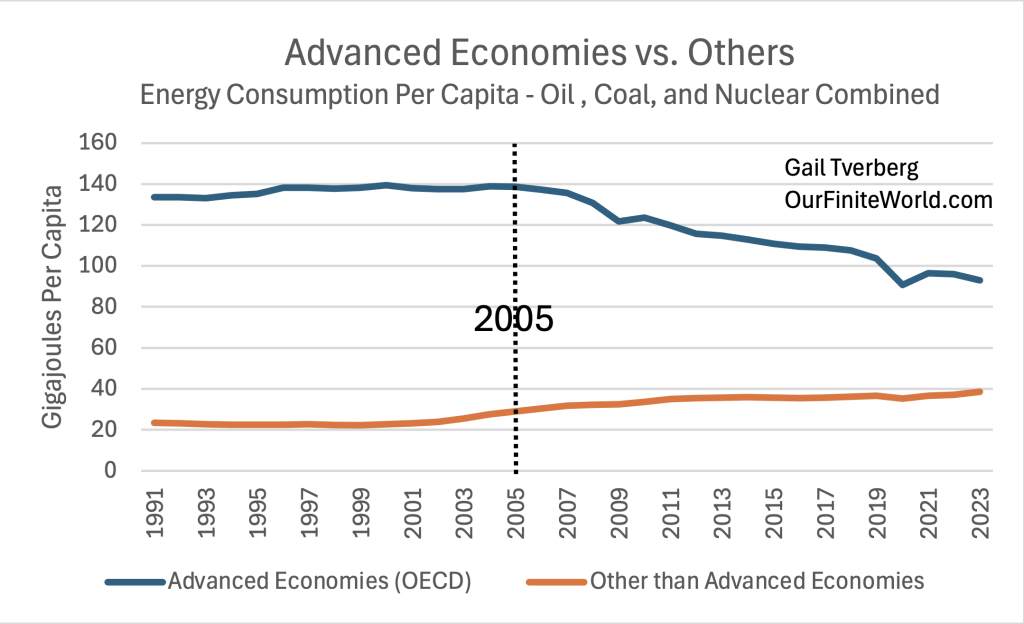

Per-capita consumption of those early used vitality sources has shrunk since peaking in 2007.

Most of us bear in mind the Nice Recession of 2007 to 2009. With a declining provide of what was cheap vitality assets, many economies have completed poorly. Most of the wealthier nations have papered over their issues with an growing quantity of debt, however the limits to this added-debt method at the moment are being hit. It’s the debt drawback that results in monetary collapse.

On this publish, I’ll elaborate on these concepts.

[1] Nations which might be as we speak’s Superior Economies (members of the Group for Financial Cooperation and Improvement (OECD)) are prone to fare poorly on this coming contraction.

The Superior Economies embrace the US, most of Europe, Japan, Australia, and some different nations. Their per-capita consumption of oil, coal and nuclear electrical energy assets has been shrinking considerably since about 2005. The 12 months 2005 was roughly the height of “typical” oil provides. Extra oil has change into accessible since this date, however this oil is mostly costlier to extract.

[2] Vitality consumption for the Aside from Superior Economies is hitting limits, too.

The Aside from Superior Economies had been capable of develop of their per-capita use of those three varieties of fuels between 2001 and about 2013, however since then, their per-capita amount of those fuels has leveled off. The large impetus for progress was China becoming a member of the World Commerce Group in 2001. World demand for cheap completed items empowered China to begin extracting coal and different minerals in amount. However coal mines deplete, simply as oil fields deplete, resulting in the flat per-capita availability of vitality provide for the Aside from Superior Economies since about 2013.

[3] With these altering patterns for the 2 teams, one potential drawback is battle.

The Aside from Superior Economies have found out that they’re creating an enormous share of the world’s items, however their per-capita use of vitality is way decrease than that of the Superior Economies. Why ought to the Superior Economies get a lot of the completed merchandise accessible from the world’s assets, when many of the work (and the air pollution) has taken place within the Aside from Superior Economies? I might anticipate any such pondering to happen in China, Russia, India, Iran and different nations on this group. These nations imagine that they might get alongside completely nicely with out the Superior Economies and their excessive utilization of vitality.

[4] With these altering patterns, a second potential drawback is monetary collapse, particularly for the Superior Economies.

Every financial system could be inspired to develop in two alternative ways: (1) By way of extra debt, not directly including to extra “demand” for completed items, or (2) By way of added provide of cheap vitality merchandise. Including debt to tug the financial system ahead appears to work nicely if there’s not an issue with hitting useful resource extraction limits. As soon as an financial system begins hitting useful resource extraction limits, nevertheless, the added debt partly provides inflation, moderately than completed items and providers, to the output combine. Thus, the debt method now not works nicely.

The world as a complete is now hitting useful resource extraction limits. Not solely do particular person residents change into sad with the upper inflation degree, however buyers demand larger rates of interest for lending. This larger curiosity value turns into an enormous drawback for the Superior Economies that have already got very excessive debt ranges.

A lately issued report by the US Congressional Finances Workplace (CBO) reveals what is occurring within the US.

In a way, the stories that the CBO publishes are “Finest Case” situations. The stories are optimistic in two alternative ways: (1) They assume that no extra added-debt bail-out applications might be wanted, as had been used a number of instances in recent times, and (2) They assume that inflation will shortly fall to 2%, in order that rates of interest can fall shortly and keep decrease any further.

Even with these assumptions, the outcomes are disturbing. Notice that on Determine 3 (in each charts proven), the particularly vital improve in debt begins round 2008. That is when the US, and certain many of the different Superior Economies, began to cover their vitality issues by utilizing extra debt stimulus.

Even when probably the most optimistic potential estimate of the longer term “main deficit” is made, and when probably the most optimistic potential forecast of future “web curiosity” outlays is made, there’s nonetheless an enormous build-up of debt. The implication is that very giant tax will increase might be wanted to keep up present applications. Even with these large tax will increase, the issue will worsen and worse, 12 months after 12 months. There’s a want to chop again on current authorities applications to keep away from including the necessity to pay much more curiosity on debt sooner or later.

[5] If an financial system is compelled to shrink again, money owed of all types change into harder to repay with curiosity.

Any financial system must develop, in an effort to repay debt with curiosity. A rising financial system has a surplus with which to pay curiosity.

However, a shrinking financial system tends to result in main debt defaults. Leveraged debt is very prone to trigger issues.

The CBO is now forecasting that the US authorities may run into debt restrict issues as quickly as July 2025. Maybe the US authorities will discover methods across the present obvious shortfall, however the subject of the federal government not having the ability to meet its debt obligations with out main tax will increase or reductions in applications nonetheless looms within the background.

I anticipate that throughout the subsequent three months, we’ll begin to see mortgage defaults of some sort, akin to defaults by hedge funds. Governments will need to step in, however they are going to be restricted by their very own monetary issues. Defaults on many different kinds of money owed are prone to begin going down, as nicely. If inflation charges rise, and rates of interest rise with them, defaults on many sorts of debt may begin going down.

[6] It appears seemingly that just about all of the Superior Economies may have comparable issues.

The Superior Economies have tended to supply their residents many advantages, together with pensions for the aged and a few sort of healthcare protection. Lots of them have financially supported what they’re hoping might be vitality varieties that can take the place of the vitality varieties they appear to be shedding.

If an financial system is just not rising as quick because it has up to now (due to low vitality consumption progress, and lack of debt stimulus), or is definitely shrinking, these economies are prone to face a alternative between both slicing again on promised applications or elevating taxes. Governments will discover themselves needing to chop again on applications that they’ve promised to their residents, or, alternatively, they might want to default on their debt.

[7] Including to the issues of the Superior Economies would be the subject of products and providers needing to be made nearer to dwelling.

With out sufficient oil for all functions, a logical option to reduce is to make use of much less oil for worldwide transport. This could are inclined to reverse the pattern towards globalization that began a few years in the past.

Determine 4 reveals that the US began shifting heavy trade to different nations with higher provides of oil as early as 1974. The Kyoto Protocol of 1997 gave one more reason (or excuse?) for shifting heavy trade to nations with inexpensive, extra plentiful, vitality provides.

I anticipate that within the subsequent few years, the Superior Economies are prone to want to maneuver industrial manufacturing again nearer to dwelling, to save lots of on restricted world oil provides. This might be troublesome to do, particularly in a timeframe of lower than 20 to 30 years. New mines might be wanted for minerals, however the lead instances on these are very lengthy, usually 13 years or extra. New processing crops for these minerals will seemingly be wanted as nicely, probably including to the lead time. Complete new, brief provide chains might be required. Lastly, items and providers manufactured nearer to dwelling will must be transported to residents, generally in new methods.

Lots of as we speak’s manufactured items require imports of minerals from China or Russia. To the extent that particular minerals from these nations can now not be imported, extra nearer sources might be wanted. This may additional add to manufacturing difficulties.

[8] It is not going to be shocking if governments, or components of governments, collapse.

Historical past signifies that when civilizations attain useful resource limits, governments are inclined to fail. A latest instance of this was the collapse of the central authorities of the Soviet Union in 1991, after an prolonged interval of low oil costs. The Soviet Union was a serious exporter of oil, and the low oil costs (plus different inner issues) led to the lack to repay promised debt. The separate republics throughout the Soviet Union remained, so the folks weren’t left utterly with out a authorities. I anticipate one thing comparable could occur elsewhere sooner or later.

[9] Historical past means that even in a monetary collapse, your complete financial system is not going to collapse, abruptly.

Incremental modifications are prone to happen. Governments are prone to attempt to make cutbacks. Monetary investments are prone to do particularly poorly within the subsequent a number of years, and high-paying jobs appear prone to disproportionately disappear. The financial system will now not have the opportunity help as many specialists as are working as we speak, in lots of industries.

The electrical energy provide seemingly received’t fall off abruptly; as an alternative, electrical energy will change into more and more intermittent, with some areas having extra outages than others. Diesel and gasoline will maybe be accessible, a minimum of a part of the time.

New automotive gross sales within the Superior Economies are prone to fall very quickly, leaving residents largely coping with used automobiles, and the issue of discovering applicable alternative components for used automobiles. The issue of “empty cabinets” in shops is prone to return and worsen.

There’ll seemingly be an growing divide between the relative handful of residents who’re doing nicely, and the various others. In truth, we’re already seeing a pattern on this course within the US. However a lot of as we speak’s large spenders are prone to be knocked down in any coming financial contraction.

[10] Maybe the excellent news on this contraction is that main worldwide wars will not be an issue.

As an alternative, civil wars and native skirmishes will be the order of the day. There will not be assets accessible to combat long-distance wars, even when many voters may favor this method. Wars give an excuse for extra debt and extra revenue for troopers, so they’re at all times standard in troubled financial instances. However a scarcity of supplies for making army provides (together with inadequate sources of antimony) and the lack to lift debt financing could impede efforts.

[11] What ought to we anticipate sooner or later?

The US and lots of different Superior Economies are seemingly heading right into a worse and longer lasting monetary disaster than the 2008 disaster, beginning as quickly as this summer time. The issue will seemingly not begin out as a full monetary collapse. As an alternative, varied leveraged debtors will encounter difficulties. Steadily, the funds and really constructions of many authorities organizations are prone to be threatened. Some authorities constructions that we presently rely upon could disappear.

How the long run will unfold is unclear. We all know that ecosystems typically function in huge cycles, and that financial methods are a type of ecosystem. This relationship suggests the potential for a later renewal.

Moreover, Eric Chaisson, in Cosmic Evolution: The Rise of Complexity in Nature, factors out that there’s a very long run pattern within the universe towards extra advanced and extra energy-dense constructions. His evaluation appears to recommend the potential for evolution towards a unique type of extra advanced, energy-dense financial system forward.

On this ever-changing world, there could very nicely be alternatives for private success. It should seemingly be a time of main readjustment, nevertheless. Maybe fairly a couple of folks will have the ability to do nicely if they’ll maintain their eyes open for alternatives to prosper, making the very best use (or reuse) of assets which might be accessible.

Appendix: Background on Oil, Coal and Electrical energy from Uranium

Oil Background

Oil was at one time a really cheap gas, even when adjusted for inflation to 2023’s value degree.

With the low costs that had been accessible earlier than 1970, oil could possibly be used extensively. It could possibly be used to create electrical energy, and roads could possibly be paved. Many individuals may afford automobiles who couldn’t afford them beforehand.

In 1973, oil costs soared (Appendix: Exhibit 2). Appendix: Determine 3 reveals that between 1981 and 2021, falling rates of interest helped to make larger oil costs extra tolerable. Extra debt could possibly be added, and with decrease rates of interest, month-to-month funds may keep low.

Appendix: Exhibit 2 additionally reveals {that a} large a part of the issue since 2021 is that whereas debt ranges at the moment are excessive, rates of interest is not going to keep down. Which means the price of drilling new wells is now larger, and the final value of funding within the financial system is larger.

Appendix: Exhibit 1, signifies that, since 1991, the best per-capita amount of oil that clients had been capable of afford occurred within the 2004 to 2007 interval. This was a time wherein dwelling mortgage debt stimulus was used to maintain the US financial system rising; it was the time of Alan Greenspan and the NINJA (No Revenue, No Jobs, No Belongings) dwelling loans. The ensuing sub-prime US housing bubble is reported to have lasted from 2003 to 2007. This sub-prime debt bubble is a minimum of a part of what led to the 2008 monetary disaster.

The excessive US demand for oil on account of the house mortgage debt bubble of 2003 to 2007 helped world oil costs to rise and consumption to rise. Extra lately, per-capita world oil consumption has been down, particularly in 2020. Oil provide has not regained the 2004 to 2007 degree, and even the 2018 degree, in the latest estimates.

Oil extraction has historically been an enormous supply of tax {dollars}, particularly for oil exporters, even when oil was offered at comparatively low costs. Something that replaces oil must fill this position as nicely, as a result of the financial system wants vitality (and taxes from vitality) to function. This tax income is a option to share what is typically known as the “surplus vitality” of the oil with the federal government of a rustic. At presently excessive extraction prices, this surplus vitality profit is essentially disappearing.

Coal Background

Appendix: Determine 1 reveals that the gas in second largest provide has been coal. Its provide grew significantly after 2001, when China joined the World Commerce Group. This progress in coal provide didn’t final lengthy as a result of coal that was cheapest-to-extract and closest-to-markets shortly depleted. Appendix: Determine 1 reveals the height in per capita coal provide was hit in 2011.

Coal helped begin the economic revolution. By 1700, it grew to be the dominant gas in England. Coal step by step changed firewood and was utilized in many new methods.

Appendix: Determine 5 reveals the methods coal has lately been used. It’s used immediately in trade, in addition to being burned for electrical energy.

Nuclear Background

Appendix: Determine 1 reveals that the height in per-capita nuclear vitality manufacturing occurred in 2001. However at one time there had been nice hope for nuclear energy.

It was identified as early because the Fifties that fossil gas provides had been prone to face depletion points as quickly as 2050. Physicist M. King Hubbert was of the assumption that electrical energy from uranium can be too low cost to meter. He additionally believed that the amount of electrical energy produced could possibly be very excessive. Neither of these items has come to move.

Early nuclear reactors had been constructed to keep away from issues that engineers may see wanted to be prevented. This method led to accidents: Three Mile Island (1979), Chernobyl (1986), and Fukushima (2011). It turned clear that design upgrades had been wanted, elevating prices and lengthening timelines for constructing reactors.

In idea, there’s fairly a little bit of uranium to be extracted, however getting the worth up excessive sufficient, for lengthy sufficient, has been an issue. The World Nuclear Affiliation reveals this chart of manufacturing by 2022. Manufacturing in recent times has been decrease than consumption.

Fortuitously, there was a provide of nuclear warheads which could possibly be down blended to supply uranium for nuclear reactors. This provide of nuclear warheads is now near being exhausted. If nuclear energy is to be expanded, extra uranium might be wanted.

Different particulars have confirmed problematic as nicely. In idea, the spent gas could be reprocessed and used as gas for reactors, however in apply, this course of appears to be expensive and time-consuming to arrange.

One other subject is the excessive value of constructing new nuclear reactors, and the necessity for debt to fund this value. Clearly, the upper the rate of interest, the upper the fee. Not many organizations can fund these excessive prices, upfront of really getting electrical energy out and delivered to clients.

Generally, to maintain prices low for purchasers, the sale of electrical energy is priced on the margin. In lots of locations, electrical energy from wind generators and photo voltaic panels is given “precedence.” Consequently, wholesale electrical energy costs are typically too low for electrical energy from nuclear energy crops, driving them out of enterprise. The value degree is actually not excessive sufficient to pay excessive taxes to governments. Such a margin can be wanted if nuclear had been to have an opportunity of actually changing the advantages we’ve got had up to now from inexpensive-to-produce oil.