The place might the financial system be headed now?

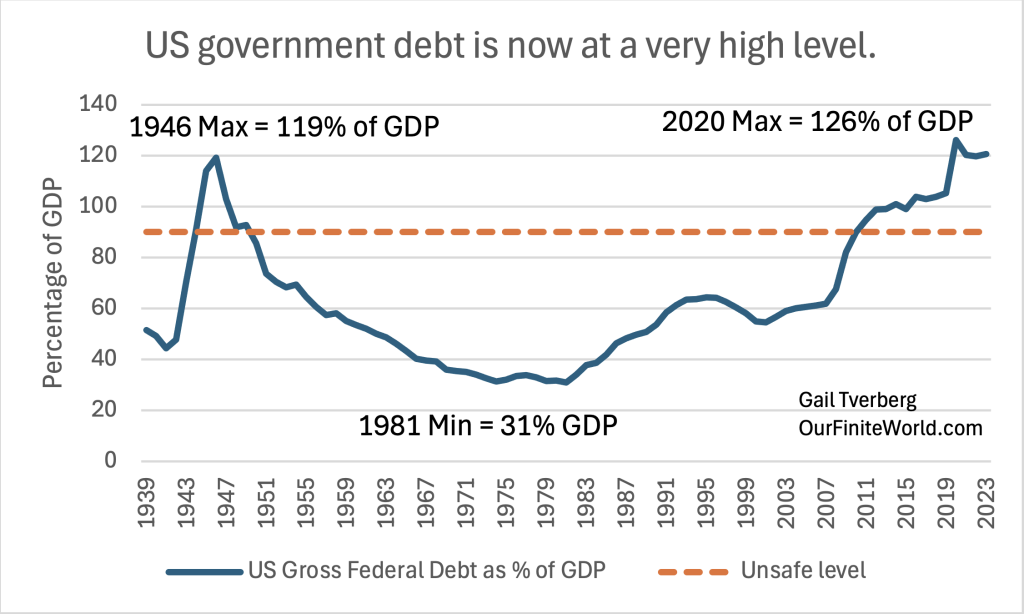

At present, there’s nice wage and wealth disparity, simply as there was within the late Nineteen Twenties. Latest power consumption progress has been low, simply because it was within the Nineteen Twenties. A major distinction immediately is that the debt stage of the US authorities is already at a very excessive stage. Including extra debt now could be fraught with peril.

The place might the financial system go from right here? On this put up, I take a look at some historic relationships to know higher the place the financial system has been and the place it may very well be headed. Whereas debt ranges and rates of interest are essential to the financial system, a rising provide of appropriate cheap power merchandise is simply as essential.

On the finish, I speculate a little bit relating to the place the US, Canada, and Europe may very well be headed. Division of present economies into components may very well be forward. Whereas the issues of the late Nineteen Twenties ultimately led to World Struggle II, it could be potential for the components which might be higher equipped with power sources to keep away from entering into one other main struggle, at the very least for some time.

[1] Authorities regulators have been utilizing rates of interest and debt availability for a really very long time to attempt to regulate how the financial system operates.

I’ve chosen to investigate US information as a result of the US is the world’s largest financial system. The US can be the holder of the world’s “reserve foreign money,” permitting demand for the US greenback (actually US debt) to remain excessive due to its demand to be used in worldwide commerce.

Evaluating Determine 1 and Determine 2, it’s clear that there’s a shut relationship between the charts. Particularly, the best rate of interest in 1981 on Determine 2 corresponds to the bottom ratio of US authorities debt to GDP on Determine 1.

Up till 1981, the modifications in rates of interest have been both imposed by market forces (“You may’t borrow that a lot with out paying a better charge”) or else as a part of an try by the US Federal Reserve to sluggish an financial system that was rising too quick for the out there labor provide. After 1981, the identical market dynamics little question came about, however the general try at intervention by the US Federal Reserve appears to have been within the course of dashing up an financial system that wasn’t rising as quick as desired.

In Determine 2, the 3-month rates of interest correspond pretty intently to authorities goal rates of interest. The ten-year rates of interest have a tendency to maneuver on their very own, maybe considerably influenced by Quantitative Easing (QE), by which the US authorities buys again a few of its personal debt to attempt to maintain down longer-term rates of interest. These longer-term rates of interest affect US long-term mortgage rates of interest.

Latest month-to-month information present that 10-year rates of interest began rising in a short time after reaching a minimal following the Covid response in early 2020. The bottom 10-year common charges came about in July 2020, and charges began shifting up in August 2020.

This means to me that market forces play a big function in 10-year rates of interest. As quickly as individuals began borrowing cash to rework or to maneuver to a brand new suburban location, 10-year rates of interest, and sure the associated mortgage charges, began to float upward once more. If this statement is right, the Federal Reserve has some management over rates of interest, however it can’t alter the 10-year rates of interest underlying mortgages and different long-term debt by as a lot as it would like.

The obvious incapacity of the Federal Reserve to regulate longer-term rates of interest to as low a stage as it will like is regarding as a result of the US authorities debt stage could be very excessive now (Determine 1). Being compelled to pay 4% (or extra) on long-term debt that rolls over might create an enormous money move difficulty for the US authorities. Extra debt may very well be required merely to pay curiosity on present debt!

[2] An evaluation of precise progress in US GDP over time reveals how profitable the altering methods in Figures 1 and a couple of have been.

Within the Thirties, the US and far of the remainder of the world have been within the Nice Despair. Rates of interest have been near 0% (not proven on Determine 2, however out there from the identical information). Varied variations of the New Deal below President Roosevelt have been began in 1933 to 1945. Social Safety was added in 1935. Determine 4 reveals that these packages briefly elevated GDP, however they didn’t solely resolve the issue that had been brought on by defaulting debt and failing banks.

Coming into World Struggle II was an enormous success for rising US GDP (Determine 4). Many extra girls have been added to the workforce, making munitions and taking up jobs that males had held earlier than they have been drafted into the military.

After the struggle was over, the entire variety of jobs out there dropped enormously. In some way, non-public sector progress wanted to be ramped, utilizing debt of some sort, to offer jobs for the returning troopers and others left with out work. An considerable provide of fossil fuels was out there, if debt-based demand may very well be put into place to tug the financial system alongside. Packages have been put into place to get factories working once more making items for the civilian financial system. Further jobs and power demand have been created by upgrading {the electrical} grid, rising pipeline infrastructure, and (in 1956) beginning work on an interstate freeway system.

In the course of the interval between 1950 to 2023, the common progress charge of the US financial system regularly stepped downward, regardless of all the debt-based stimulus that was being added after 1981, as proven in Determine 5.

[3] Whereas rising debt is essential for pulling an financial system ahead, a rising provide of power is important to truly produce bodily items and companies.

Financial progress entails producing bodily items and companies. The legal guidelines of physics inform us that power provides of the correct sorts, in the correct portions, are essential to make the products and companies that the bodily financial system relies upon upon.

The speed of progress of world power provide has been stepping down through the years, as the best (and least expensive) to extract fossil fuels are likely to get extracted first. The typical charge of improve of all power provide (not simply fossil fuels) is proven in Determine 6:

Evaluating Figures 5 and 6, we will see that common annual US GDP progress roughly matched progress in world power provides within the first two durations: 1950-1970 and 1971-1980.

Within the interval 1981-2007, common US GDP progress (of three.2%) soared above world power consumption progress (of two.1%). I’d attribute this primarily to outsourcing a big share of the US’s industrial manufacturing because the financial system shifted to turning into extra of a service financial system. There have been a number of benefits to shifting to a service financial system. US oil provide had turn out to be restricted, and a service financial system would use much less oil. Additionally, the prices of imported items could be a lot decrease than these made within the US for a number of causes, together with extra environment friendly newly constructed factories, lower-wage staff, and using cheap coal as a gasoline as an alternative of oil.

The encouragement of elevated use of “leverage” below Ronald Reagan within the US and Margaret Thatcher within the UK little question added to the impact of utilizing extra debt proven in Determine 1. The US authorities began borrowing more cash, quite than rising taxes. Companies turned bigger and extra complicated. Worldwide commerce began taking part in a bigger function.

Latest low progress in power provides has created an financial downside that added debt has solely partially been in a position to cover. (Within the newest interval (2008-2023), each US common GDP progress (at 1.8%) and world power consumption progress (at 1.5%) have been very low.) Determine 1 reveals that the US added enormous quantities of debt, each after the 2008 monetary disaster, and on the time of the Covid response in 2020. If it weren’t for these enormous debt infusions, US GDP progress would little question have been a lot decrease. GDP counts the amount of products and companies produced, not whether or not added debt has been used to fabricate these items, or whether or not prospects have used debt to buy these items.

[4] In some methods, the world financial system immediately is just like the financial system of the Nineteen Twenties.

The Nineteen Twenties have been characterised by each the rising use of debt (particularly client credit score), and huge wage and wealth disparities. This was a time of innovation. Some farmers had fashionable new tools that enormously enhanced effectivity, whereas most farmers couldn’t afford this tools.

Determine 7 reveals a sample of wage disparity that operates in exactly the wrong way from the rate of interest sample proven in Determine 2. The decrease the rates of interest, the extra the focus of wealth amongst a really small portion of the inhabitants. The upper the rates of interest, the extra evenly wage and wealth is split.

A comparability of Determine 7 with Determine 6 and Determine 5 reveals that (at the very least for the years since 1950), quicker power consumption progress appears to result in quicker financial progress. With quicker financial progress, the financial system can assist increased rates of interest and better wages for lower-paid staff. There may be much less push for “complexity” to attempt to substitute staff with machines.

When power consumption progress is low, the financial system tends to develop extra slowly. The rates of interest that companies and people can afford to pay are comparatively low. With low rates of interest, asset costs of every kind soar as a result of month-to-month funds to purchase these property fall. The costs of shares, bonds, houses, and farms are likely to soar. The already wealthy turn out to be richer and richer, because the poor are more and more squeezed out of the financial system.

Physicist Francois Roddier has stated that physics dictates the result of extensively diverging incomes when power provide is low. It takes a lot much less power to provide an financial system of some wealthy individuals and plenty of poor individuals than it takes to assist an financial system with comparatively equal incomes. The overwhelming majority of the supposed wealth of the wealthy exists as guarantees that may solely be fulfilled sooner or later if there’s sufficient power of the correct sorts to satisfy these guarantees. Their promised future wealth doesn’t have an effect on immediately’s power use. Whereas the power use of wealthy individuals is considerably increased than that of poor individuals, a lot of the distinction disappears when an individual considers the truth that a lot of their wealth is actually “paper wealth” that will or could not really be current as the longer term really unfolds.

Each the Nineteen Twenties and the most recent interval (2008-2023) are very low energy-growth durations. The truth that (2008-2023) is a low power progress interval (at 1.5% per yr) may be seen on Determine 6. Power provide was rising even barely extra slowly within the Nineteen Twenties (based mostly on information from Vaclav Smil’s Power Transitions). Inhabitants was rising by 1.1% per yr in each the Nineteen Twenties and within the newest interval (2008-2023.) Web power consumption per capita progress was barely destructive (-0.1%) within the Nineteen Twenties and solely a really small optimistic share (0.4%) within the 2008-2023 interval. Per capita consumption had been rising rather more shortly between 1950 and 1980.

[5] The financial system turns into very fragile when the expansion of power provide is low, in comparison with the expansion of the world’s inhabitants.

Hidden beneath the floor is the issue that there’s not sufficient power to go round. This downside doesn’t present itself in excessive costs; it manifests itself in unusually massive wage disparities. Very wealthy people (resembling Invoice Gates and Elon Musk) achieve extreme affect. Particular pursuits and their drive for earnings additionally turn out to be essential. At occasions, this drive for earnings can come forward of the well-being of residents.

Residents turn out to be extra quarrelsome. Variations between and inside political events turn out to be better. Political candidates now not deal with different candidates with the respect we’d have anticipated previously. The issue is, in some sense, the issue of a recreation of musical chairs.

Initially, the sport has as many gamers as chairs. The gamers stroll across the exterior of the group of chairs because the music performs. In every spherical, one chair is eliminated and the gamers should scramble for the remaining chairs. The one that doesn’t get a chair is eradicated from the sport.

[6] It appears to me that main components of the world financial system are transitioning from a progress mode to a mode of shrinkage.

Determine 9 provides a illustration of how the world’s rising financial system may be visualized, and the way it could change sooner or later.

The truth that progress within the consumption of fossil gasoline power provides has been retreating to decrease ranges ought to be of concern (Determine 6). Sooner or later, the world financial system might be in a state of affairs by which the quantity of fossil fuels we will extract is falling. Whereas we’ve got some add-ons to the fossil gasoline system (together with hydroelectric, nuclear, wind, and photo voltaic), they’re all manufactured utilizing the fossil gasoline system and repaired utilizing the fossil gasoline system. These add-ons would cease producing not lengthy after the fossil gasoline system stops producing. They want fossil fuels to make alternative components, amongst different issues.

The quantity of progress in power provide determines the expansion in bodily items and companies that may be produced. In durations of speedy progress, borrowing from the longer term, even at a excessive rate of interest, is smart. In durations of low progress, solely loans with a really low rate of interest are possible. When the financial system is shrinking, only a few investments can repay loans requiring curiosity.

For sure, repaying debt with curiosity turns into rather more tough in a shrinking financial system. Within the US, our underlying downside is that since 1981, the US’s monetary coverage has been “throw each instrument within the instrument field” at stimulating the financial system. We are actually working out of instruments to stimulate the financial system to develop quicker. Including extra debt isn’t more likely to work very nicely, or for very lengthy.

At this level, the numerous government-funded investments aimed toward offering inexperienced power and providing transportation by electrical energy should not paying again nicely. Residents are repeatedly being advised that there’s a want to maneuver away from fossil fuels to forestall local weather change. However world CO2 emissions proceed to rise. They merely moved to a distinct a part of the world.

[7] What does historical past since 1920 say could also be forward?

It’s onerous to see that issues will prove nicely, however we do know that historic civilizations have collapsed over a interval of a few years. We are able to hope that if we face the collapse of at the very least a part of the world’s financial system, this collapse may also be sluggish. Some intermediate steps alongside the road probably embrace the next:

(a) Inventory market collapses. After extreme hypothesis within the inventory market within the late Nineteen Twenties, the inventory market collapsed on October 29, 1929, beginning the Nice Despair. One other main crash occurred in 2008, throughout the Nice Recession. Each of those speculative bubbles appear to have been fueled by low short-term rates of interest.

(b) Drops within the costs of houses, farms, and different property. The Nice Despair is famous for main drops within the costs of farms. The Nice Recession is understood for main drops within the costs of houses. We are actually going through a state of affairs with far an excessive amount of Business Actual Property. Its worth logically ought to fall. Farmers are additionally having issue as a result of wholesale meals costs are too low relative to the varied prices concerned, together with curiosity funds regarding tools purchases and mortgages. The issue is very acute if farm property has been bought at at present inflated costs. The costs of farms logically ought to fall, additionally.

(c) Debt defaults, associated to asset worth drops. Banks, insurance coverage firms, pension plans and plenty of people proudly owning bonds might be badly affected if defaults on loans or bonds begin rising. (Actually, even when the market rates of interest merely rise, the carrying worth on monetary statements is more likely to fall.) If industrial actual property or a farm is bought and the gross sales worth is lower than the excellent debt, the financial institution issuing the mortgage might be left with a loss. This debt is usually resold, with credit score ranking companies falling quick in indicating how dangerous the debt actually is.

(d) Failing banks, failing insurance coverage firms, and failing pension plans. Even bankrupt governments defaulting on their loans.

With failing banks, there’s much less cash in circulation. The tendency is for commodity costs to fall very low, placing farmers in worse monetary form than earlier than. They in the reduction of on manufacturing. Meals manufacturing and transport use appreciable quantities of oil. Lowered meals manufacturing results in much less want for oil consumption and thus, falling oil costs. With low oil costs, manufacturing tends to fall.

(e) If a authorities survives, it could attempt to difficulty rather more debt-based cash to attempt to elevate costs. This may work if the nation is ready to produce all items regionally. However the enormous quantity of latest cash (and debt) won’t be honored by different nations. The result’s more likely to be hyperinflation, and nonetheless no items to purchase.

(f) Persecution of the wealthier individuals blamed for society’s issues. If persons are poor, and there aren’t sufficient items to go round, there’s a tendency to search out somebody accountable for the issue. In Europe, previous to World Struggle II, the Nazis persecuted the Jews. The Jews have been typically wealthy and labored in finance or the jewellery enterprise.

(g) Struggle. Struggle provides the opportunity of acquiring sources elsewhere. Determine 4 reveals that going to struggle can enormously ramp up GDP. It’s a approach of placing laid-off staff again to work. It’s an age-old resolution to not-enough-resources-to-go-around.

[8] Can any political strategy delay the dangerous impacts instructed in Part [7] above?

A rustic that may present full provide chains based mostly by itself sources, fully inside its personal borders may be considerably insulated from these issues, so long as its sources are enough for its inhabitants. I don’t assume that any of the Superior International locations (members of the OECD, which has similarities to the US and its allies) can do this immediately. The US is nearer to this superb than Europe, however it’s nonetheless a great distance away. The central and southern a part of the US, which is the place Donald Trump’s assist is powerful, is nearer to this superb than elsewhere.

Trump is advocating including tariffs on imported items. Such tariffs would work within the course of independence from China, India, and different industrialized nations. Trump additionally appears to advocate staying out of wars, wherever potential. If an space is doing nicely when it comes to power provide (together with meals provide), this is able to be a great technique.

Kamala Harris is advocating capping immediately’s meals costs. This may please city-dwellers, however it will encourage farmers to give up farming. Capping immediately’s meals costs would additionally discourage the importation of meals from elsewhere, leaving many empty cabinets in grocery shops. Not directly, it will even have an hostile impression on the world’s oil manufacturing and the amount of meals grown elsewhere.

Giving more cash to poor individuals would nearly definitely result in extra authorities debt. If nations in Europe have been to do that, it will nearly definitely devalue their currencies. They’d discover it tougher to import items from anyplace else on this planet.

Actually, the US would probably additionally encounter issue in importing as many items from elsewhere, if it chooses to offer more cash to poor individuals (and fund this generosity by means of extra debt). China and Russia would have much more motivation to desert the US greenback for buying and selling functions than they do immediately. The US, Europe, and different Superior Economies would more and more discover imported items unavailable.

Wind, photo voltaic, and electrical autos should not fixing the financial system now. Including extra debt to subsidize these efforts would probably have the identical dangerous results as including extra debt to subsidize poor individuals.

[9] A guess as to what may very well be forward for the US, Canada, and Europe.

Donald Trump is suggesting tariffs and different insurance policies that is likely to be useful for the components of the US, Canada, and Mexico that assume they could have sufficient sources to kind of get alongside on their very own within the close to future. This contains a lot of the central and southern a part of the US. Central Canada would match into this sample, as nicely. Mexico is linked by pipeline to this space, too. At the least within the US, Trump is favored in these areas.

Within the extremely populated areas alongside each US coasts, the debt-based insurance policies of Kamala Harris will appear extra cheap as a result of these sections have restricted sources to depend on, however a lot of inhabitants. The one resolution they’ll think about is extra debt. I anticipate that Europe and the coasts of Canada will comply with Kamala Harris’s methods, however with their very own leaders.

I can think about a situation by which after the US election, the US will break aside into two sections: a Trump part within the middle of the US, and a Harris portion consisting largely of the 2 coasts, and maybe a couple of northern states. The Trump part will band along with Central Canada and Mexico and attempt to hold working for some years longer. The Harris portion will be part of along with the coasts of Canada and most of Europe to get into struggle with Russia and China. The Harris portion will difficulty heaps extra debt. The Harris group will overlook that their areas can’t actually make many armaments with out an enormous quantity of worldwide commerce. Because of this, the Harris group could have nice issue in being profitable at struggle.