By Aimee Raleigh, Principal at Atlas Enterprise, as a part of the From The Trenches function of LifeSciVC

In case you are a first-time founder who has heard the phrase “This isn’t a great time to be elevating for X,” the place X is a platform, a preclinical play, a non-consensus story, I empathize! After you’ve spent years considering an concept, doubtlessly investing a few of your individual cash to generate early knowledge, and thoroughly considering by the pitch, it’s troublesome to listen to that a complete scope of firms is out of fashion for a extra cautious funding atmosphere. Elevating cash for early-stage firms is troublesome, no matter macro elements, however is especially difficult immediately.

Now greater than ever, an efficient first pitch is important for biotech firms trying to elevate capital. Whereas there isn’t a sure path to success (many extra firms search to lift funding than are in the end profitable in doing so), there are some practices that will improve your odds. My colleague Bruce wrote a publish on pitching almost 15 years in the past (!), and the recommendation is as salient as ever (although be sure to inflation-adjust for a few of the financing figures cited 😊). I figured it was value revisiting this subject, throughout the lens of the distinctive challenges of 2025.

Let’s level-set: This is among the tougher instances to fundraise for a biotech firm within the final decade

Regardless of the broader U.S. market’s restoration from the April “liberation day” meltdown, biotech has not fared so nicely. 2025 has launched actual threats to our enterprise mannequin, starting from early-stage analysis funding to regulatory interactions to drug pricing to potential upheavals to the worldwide provide chain. Most buyers dislike uncertainty greater than nearly anything, and unluckily for us 2025 has that in spades.

There’s nonetheless an abundance of capital for personal biotech financings, as many VCs raised sizeable funds prior to now 1-2 years. Primarily based on an evaluation of latest Pitchbook knowledge, I estimate >$55B in dry powder (largely for personal offers) throughout >200 life sciences VCs within the U.S. and EU. That’s extraordinarily wholesome by historic requirements, and by itself may assist tens of hundreds of seed raises or tons of of bigger personal financings of $100M – $300M every. We’re more likely to proceed to see capital skew in direction of the latter sort of deal, with focus in clinical-stage, asset-centric performs. And that’s not essentially a foul factor – personal biotech firms are more and more taking applications later in scientific growth, and that inherently requires bigger raises to fund by essential milestones. That stated, if fewer whole firms are accessing capital within the personal markets, it does beg the query of how one can successfully pitch so that you’ve got the perfect shot at funding your breakthrough applications.

With that in thoughts, let’s take a deeper dive into funding fundamentals, mechanics, and finest practices to extend odds of success. These pointers are geared in direction of first-time founders, however some are relevant even for well-seasoned groups making ready to lift. In fact, every entrepreneur and firm are completely different, as are the enterprise corporations and particular person buyers on the receiving finish of a pitch. Shared listed below are my views, however they’re one among many so take them with a grain of salt!

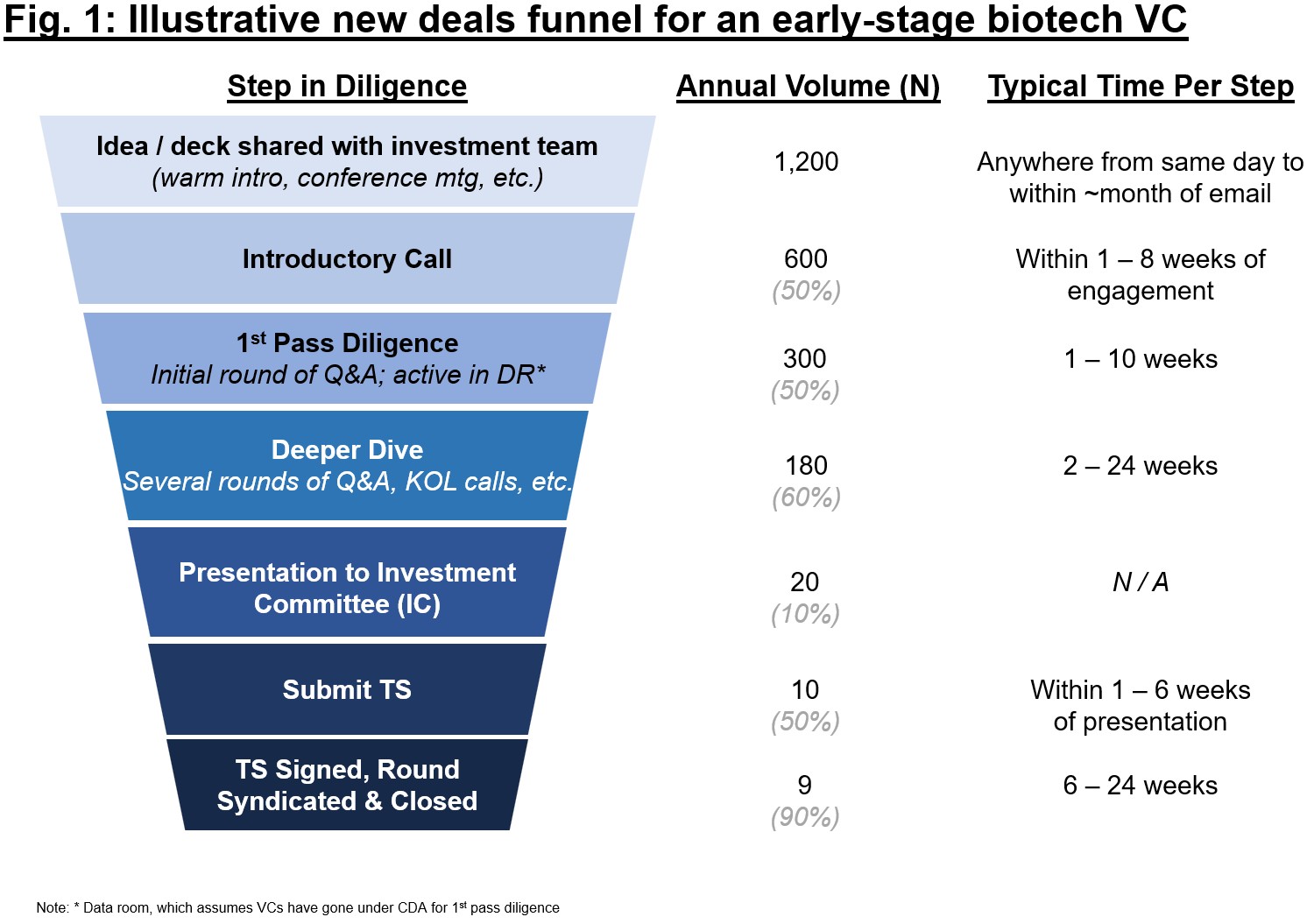

Enterprise financing realities: only a few offers make it from first pitch all the way in which to syndicated deal

What number of inbound pitches does a “typical” VC obtain yearly? Fig. 1, whereas extremely illustrative, captures what a mean annual deal stream could seem like for an early-stage biotech VC. In case you are an entrepreneur, think about that your deck might be one among 10-30 to come back by the funnel in a given week. It’s in your finest curiosity to set it up for achievement in one of the best ways potential – we’ll dig in on finest practices beneath. Given timelines can range broadly and are more likely to take longer immediately than just a few years in the past, put together your self for a marathon and never a dash in relation to financing.

Recommendation to entrepreneurs who’re pitching to VCs

Beneath are some suggestions particularly to enhance odds of success within the earlier steps of the funnel, the place attrition charges are excessive and planning forward can go a good distance. Whereas I’m positive a few of these items of recommendation are shared by others, have in mind each VC is completely different when it comes to model and preferences.

Earlier than you start:

- As illustrated in 1 above, be reasonable with your self about chance of success and timing for a profitable financing. It’s not atypical to see some investments (no matter whether or not they’re Seed or Collection C) take 9-12 months to shut, and today it could take even longer.

- Map out expectations for the financing. Prospectively outline once you anticipate having a learn on momentum – what does success seem like? In the event you get to that time limit and haven’t achieved desired momentum, stage set. Are points of your pitch not touchdown and will they be reworked? It’s useful to pay shut consideration to suggestions (each specific and implicit) and attempt to tackle early.

- Given pitching is in the end a numbers recreation, many entrepreneurs might want to pitch to numerous VCs to transform the few who will in the end come right into a deal. In case you are pitching a seed idea, possibly that whole quantity is 50. That’s lots of pitches to sit down by – earlier than going after them all of sudden, think twice about “tiering” buyers primarily based on match (together with stage, test measurement, sorts of firms through which they’ve beforehand invested, geography, and so on.). From there, you may attain out to buyers in groupings, such because the beneath:

- First, schedule just a few lower-stakes calls to observe the pitch and solicit sincere suggestions. Nice if these are pleasant faces, however be sure they can present candid and rigorous suggestions.

- Subsequent, think about the ~10 or so buyers who’re probably highest precedence – nice overlap in curiosity, stage, write sufficiently big checks to guide a spherical, and so on. The objective is to attempt to construct momentum with teams of highest chance to transform

- Then come the subsequent set of ~10 – maybe these are corporations for which your organization’s thesis appears to suit squarely in technique, however they write barely smaller checks, or sometimes lead, and so on. If there may be momentum within the first group of buyers, that may assist drive this second wave to be expedient with diligence

- Batch out corporations in units of ~10 or so and arrange “guidelines” for reaching out (e.g., when you get a sure threshold of buyers passing). Attempt to keep a constant variety of buyers listening to the pitch, within the knowledge room, and so on. so that you simply keep momentum.

- If that is your first time pitching, do not forget that VC corporations will be extra completely different than they’re related! Take a look at this prior publish for a primary primer on early-stage biotech VC.

- The pitch deck shouldn’t be thrown collectively in a single day

- Give your self not less than a month (and ideally extra) to iterate. I can’t stress sufficient how essential it’s to solicit (and take heed to / act on!) early suggestions.

- The “aha” of the pitch needs to be apparent to a brand new reader of the deck, with out requiring a voiceover. Almost each deck is reviewed shortly for relevance and preliminary curiosity – if the narrative is so difficult it can’t be succinctly pitched totally in deck format, rethink how you’re speaking the story.

- Just lately I’ve seen increasingly more teams share each a fast 1 or 2-page “govt abstract” of a deal along with, or rather than, a deck. My private choice is all the time for a deck, as oftentimes the summaries are so high-level that it’s inconceivable to establish true differentiation of a expertise or program. However to every their very own! Some buyers could want the written govt abstract, so think about having one able to go in case it’s requested (or if you’re making an attempt to A/B check your pitch electronic mail, which will also be an insightful observe).

- Refine what you’re asking for and why

- Be reasonable in regards to the differentiated profile for this system(s) you’re pitching. VC buyers have their very own set of buyers (Restricted Companions, LPs) that they report back to, so be sure there’s a clear path to applications that may generate worth if they’re profitable. VCs will not be altruists who’re tasked with pushing biology ahead – they should have a way of what return profile could seem like for them after they make investments.

- When fascinated by the quantity of capital you’re asking for, think about what you may be de-risking within the financing window, and don’t shrink back from asking (and answering) the “killer” questions early on.

- Ask for sufficient capital. Usually I see pitches funding simply barely by an inflection level (e.g., preclinical PoC in a related mannequin for seed offers, Ph1b or Ph2a knowledge in a Collection A). Budgets and timelines broaden 95%+ of the time – do your self a favor and pitch for a financing to cowl the bottom case funds plus 6 months of operations.

- Search recommendation from a number of (cheap) advisors. For first-time founders, attempt to solicit balanced views from a number of sources when planning out your financing technique. The fundraising dynamics are very completely different in tech in comparison with biotech, so bias your number of advisors for enter in direction of the sorts of corporations you may be pitching.

- Getting the intro: heat is finest. If you find yourself able to share your story with prioritized buyers (and you’ve got refined your pitch with suggestions, per above), intention for private connections vs. chilly emails. Whereas we definitely do take pitches that originate from chilly outreach, it typically goes a lot additional if a mutual connection can share a blurb in regards to the story and also you as a founder – consider it as a excessive ROI method to improve your odds of progressing to step #2 within the funnel in 1. Take the time to map out mutual connections earlier than deciding how finest to interact with a given agency or investor.

Whereas pitching:

- Perceive your viewers. In case you are an entrepreneur pitching a novel biology story for seed financing to us at Atlas, we’re going to deeply diligence the mechanism and / or expertise. I typically see pitches which are too high-level, which makes it difficult to dig into particulars and assess differentiation. Different corporations could not need to spend >50% of the time on the science. It’s all about realizing your viewers and adapting in real-time to suggestions throughout the assembly.

- Relatedly, attempt to not give the identical rote pitch to each VC agency. Dynamically refine the story primarily based on questions, engagement, any reside suggestions, and so on. Is one thing not resonating? Think about pausing to elucidate it otherwise. In the end every pitch is a trial-run of a possible partnership – all sides needs to be intellectually versatile and respectful, so it is a good dry run of the dynamic.

- Think about the raise you’re asking of buyers. Clearly, an investor needs to be engaged within the story, do their homework, and ask questions respectfully. However be sincere with your self when pitching a sophisticated story if you find yourself asking buyers to “get it” too shortly with out the suitable stage of rationalization. As a founder, you’re embedded in your thesis and pitch, whereas an investor listening to it for the primary time is probably going evaluating your story plus maybe 10 others (see 1) in a given week. Fastidiously craft the story (each verbal and written) to attempt to cut back friction in attending to the “aha” second.

- Recommendation for when an investor passes: normally, attempt to withstand the urge to “right” the investor and as an alternative use the move as a chance to solicit significant suggestions that may assist you hone the story for the subsequent spherical of discussions. It’s extraordinarily uncommon that upon passing, an investor can be satisfied to rethink (until there may be new knowledge or market circumstances, like an exit in the identical area), so there may be comparatively little to realize from making an attempt to highschool an investor, and infrequently leaves them feeling belittled and turned off by the interplay.

It goes each methods – recommendation to early buyers

Having additionally pitched offers myself, just a few fast phrases of recommendation to fellow buyers, particularly these beginning out of their careers:

- Goal to get to some crucial go/no-gos in a primary name (valuation, stage, indication focus). It’s robust for a small staff to obtain a move after a number of rounds of time-consuming Q&A for an “apparent” purpose that’s knowable from the non-con deck.

- Typically we expect we’re being type by digging in on a deal that’s clearly off-strategy, however the kinder strategy could also be to let the staff realize it’s not in-scope and supply to as an alternative present clear and real suggestions with out asking the staff for an enormous raise.

- Keep in mind groups are sometimes pitching on high of their “day jobs” (i.e., protecting all experiments, discovery campaigns, scientific trials, and so on. operating) – give attention to the crucial questions in Q&A vs. aiming to boil the ocean.

- To the extent potential, share suggestions when passing on a deal. Depth and extent of suggestions ought to roughly scale with time spent (from each you and staff). In the event you recommend datasets you’ll have favored to see or different motion gadgets, attempt to verify these are in truth actions that, if staff comes again to you after profitable completion, would change your thoughts. A laundry record is normally not as useful if it wouldn’t transfer the needle for you, and should find yourself distracting the staff from true worth era in the long term.

Parting recommendation to first-time founders

In the end, it’s a two-way road: buyers and entrepreneurs are every diligencing the opposite for potential match throughout the pitch. And that match is essential – an funding would possibly characterize the beginning of a 5- or 10-year relationship that may face immense enthusiasm, heartburn, and all the pieces in between. The excellent news is almost everybody on this trade is extremely motivated to carry medicines to sufferers, so when the trail ahead is unclear or the going will get robust in an unsure market, maintain that finish objective in thoughts. I hope these ways could assist present some readability to these taking the leap into entrepreneurship. As Bruce talked about in his publish 15 years in the past, “we stay up for listening to about your startup.”