E-newsletter Signup – Below Article / In Web page

“*” signifies required fields

Turnstone Biologics was set as much as develop a pioneering class of medication again in 2014. However a decade later, it was hanging by a thread, having slashed most of its pipeline. Following a number of rounds of layoffs, the cash-strapped biotech’s acquisition is its saving grace. How did all of it go down, and what’s in it for Turnstone’s purchaser, XOMA Royalty?

Turnstone Biologics: from aspirations of being a most cancers therapeutics chief to layoffs and pipeline cuts

When Turnstone Biologics was based, its crew had excessive hopes for the California-based biotech to “lead the battle in opposition to stable tumors.” At first, it was eager on creating oncolytic viruses, that are engineered to assault and kill most cancers cells.

This was across the time that pharma giants took a shining to including oncolytic viruses to their rosters. So, Turnstone caught the attention of biopharmas, similar to AbbVie and Takeda. It landed a $90 million deal with AbbVie in 2017 and a $120 million one with Takeda in 2019. Nevertheless, each offers have been terminated in 2021 and 2022, with Takeda returning its oncolytic virus candidate RIVAL-01. This spurred layoffs in 2022.

Quickly sufficient, Turnstone expanded its focus. It bought the California-based startup Myst Therapeutics to come up with the latter’s tumor-infiltrating lymphocyte (TIL) remedy pipeline, changing into a contender in an area that included fellow American biotechs Iovance Biotherapeutics – which bagged regulatory approval for its pores and skin most cancers TIL Amtagvi final yr – and Obsidian Therapeutics.

Turnstone’s pipeline appeared formidable at first, with its new lead TIL candidate TIDAL-01 getting into the clinic to deal with a spread of cancers in 2022. Completely different from CAR-T therapies, TILs are sometimes extracted from a affected person’s tumor and expanded exterior the physique earlier than being infused again into the affected person. These cells are naturally in a position to acknowledge markers on most cancers cells to then assault them.

Whereas its massive pharma partnerships ended, Turnstone’s religion in TIL therapies led to it going public for $80 million in 2022. This was at a time when biotech preliminary public choices (IPOs) have been on a low, as inventory costs dropped severely throughout an financial downturn throughout the trade, after the sector’s heyday in 2021.

Then in August final yr, the biotech revealed encouraging preliminary part 1 outcomes for TIDAL-01. It had a 25% general response fee (ORR) and 50% illness management fee (DCR) within the first 4 sufferers with superior colorectal most cancers who got the remedy. Furthermore, a whole response was achieved in closely pre-treated late-line affected person, with progression-free survival extending past one yr.

Nevertheless, this was additionally when Turnstone narrowed TIDAL-01’s focus to deal with solely colorectal most cancers, head and neck squamous cell carcinoma, and uveal melanoma within the clinic, ditching cutaneous melanoma and breast most cancers indications. It then lower 60% of its workforce to “align sources in direction of manufacturing and medical growth,” in response to Sammy Farah, Turnstone’s president and chief government officer (CEO).

Then, issues obtained even worse. The biotech let go of its solely remaining candidate, TIDAL-01, and axed extra jobs, blaming manufacturing prices in February. It additionally introduced that it was open for an acquisition.

XOMA Royalty pays Turnstone to wind down operations

So, in late June, XOMA Royalty swooped in to purchase the most cancers therapeutics firm that was as soon as price $80 million for round $7.9 million. It supplied $0.34 per share in money to Turnstone in change for the remainder of the latter’s money reserves, which was round $21.8 million in March, in addition to its TIL pipeline, together with the discontinued medical candidate TIDAL-01.

As XOMA deemed the corporate as acquisition-worthy, it obtained a charge to accumulate and wind down the corporate’s remaining operations and return capital to Turnstone’s shareholders, defined Brad Sitko, chief funding officer of XOMA Royalty.

“We’ve dubbed this course of Liquidation as a Service (LaaS), making a ‘win-win’ state of affairs for our shareholders and their shareholders. This ‘charge’ supplies extra capital on our stability sheet to accumulate extra royalties, repurchase XOMA shares, and run our enterprise. Turnstone’s traders have a liquidity occasion the place we unlocked worth, and they can obtain money for his or her shares rapidly, with out the lengthy and costly means of winding down a enterprise,” mentioned Sitko to Labiotech.

That is XOMA’s second buyout in 2025. In a $30 million royalty deal, it purchased the milestones and royalties of the drug mezagitamab from the Swedish drug developer BioInvent in Could. The part 3 anti-CD38 monoclonal antibody was licensed by Takeda from BioInvent to additional develop it for treating main immune thrombocytopenia, a bleeding dysfunction. Simply in April, the Swedish biotech obtained a $1 million milestone fee from Takeda for the drug. Now, the milestones price as much as $16.25 million will probably be earned by the royalty aggregator XOMA Royalty.

“XOMA is aware of mezagitamab fairly properly on condition that we already personal a part of the royalty, and imagine Takeda has confidence on this part 3 drug and the long run market potential primarily based on their current analysis and growth (R&D) day. We have been happy to offer capital to BioInvent by means of a royalty monetization, so they might put money into their oncology pipeline,” mentioned Sitko. “The chance to accumulate extra of the mezagitamab royalty offered itself, and XOMA was excited to have the ability to present capital to BioInvent in change for upsizing our royalty.”

The antibody drug was born from BioInvent’s n-CoDeR antibody library containing greater than 30 billion human antibody genes saved inside phage viruses in take a look at tubes. It kicked off part 3 trials final yr after it had snagged quick observe and orphan drug designations from the U.S. Meals and Drug Administration (FDA).

Royalty offers on the transfer within the biopharma sector: XOMA inks offers through the years

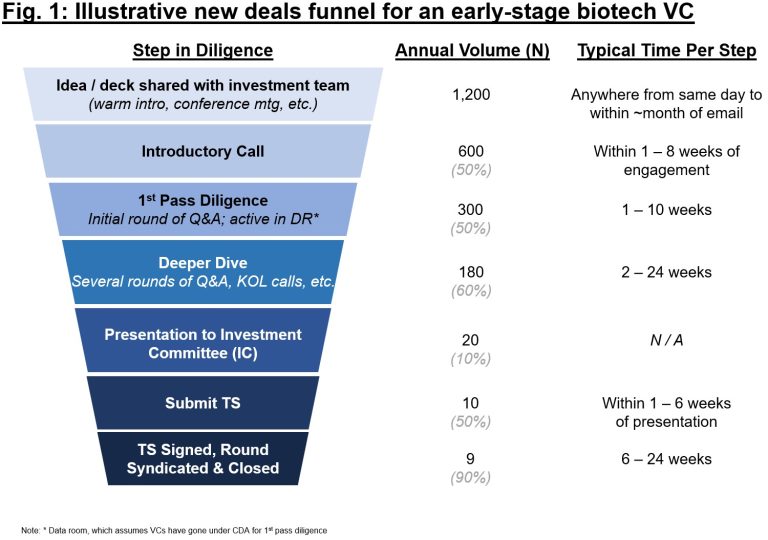

Within the biopharma trade, royalty aggregators basically purchase the rights for future royalty and milestones from corporations by providing money up entrance. By shopping for the rights of those drug candidates, they get hold of a stake in potential revenues.

“Royalty offers are an vital different to promoting shares, and subsequently one other software within the chief monetary officer’s (CFO’s) software chest when determining methods to fund a medical program to a important inflection level,” mentioned Sitko.

Sitko believes that the biotech trade is “extra targeted than ever” on capturing shareholder worth, “which means producing worth on a ‘per share’ foundation.”

However XOMA operates a bit otherwise from different royalty aggregators, in response to Sitko. They supply cash to biotechs in change for at-risk, future funds from partnered packages.

“A biotech firm companions with a pharma, and the biotech receives an upfront fee in addition to a promise of milestones and royalties if this system is profitable. XOMA Royalty supplies non-dilutive, non-recourse capital right this moment in change for these future milestones and royalties. We’re the one royalty aggregator who has executed this in any respect phases of medical growth – part 1, part 2, part 3, and business.”

“A biotech firm companions with a pharma, and the biotech receives an upfront fee in addition to a promise of milestones and royalties if this system is profitable. XOMA Royalty supplies non-dilutive, non-recourse capital right this moment in change for these future milestones and royalties. We’re the one royalty aggregator who has executed this in any respect phases of medical growth – part 1, part 2, part 3, and business,” mentioned Sitko.

Late final yr, XOMA purchased New York-based drug developer Pulmokine for $20 million, selecting up the kinase inhibitor seralutinib alongside the best way. The candidate, which is in part trials, is being examined to deal with pulmonary arterial hypertension, a sort of hypertension that impacts the blood vessels that carry blood from the guts to the lungs, known as the pulmonary arteries. If seralutinib does properly within the clinic and past, XOMA stands to make as much as $25 million in milestone funds.

What do royalty offers convey to the desk?

Whereas royalty offers usually are not distinctive, they aren’t typical within the biopharma sector, particularly since fairness offers and partnerships have been the cornerstone of the trade. However the 2020s have seen a spike in such a funding. One of the notable royalty funding offers was Blackstone Life Sciences’ $2 billion collaboration with Massachusetts-based Alnylam Prescribed drugs to advance RNA medicines in 2020, at a time when the COVID-19 disaster was at its peak.

“Royalty offers are rising in biopharma as corporations are extra inventive methods to boost capital in difficult fairness markets. Royalty monetization can typically be cheaper than the price of fairness dilution and extra versatile than debt, which must be repaid and may be onerous,” mentioned Sitko. “Royalty offers are sometimes non-recourse, which permits biotech corporations to run their enterprise how they see match – unencumbered and with freedom to function.”

And up to now yr, a number of biopharmas have resorted to signing royalty offers with the likes of Royalty Pharma and HealthCare Royalty. Royalty Pharma, particularly, bankrolled a couple of pipelines of late. It plans to spend as much as $2 billion on Revolution Medicines for a portion of Revolution’s earnings if its lead most cancers drug enters the market.

Equally, it inked a $125 million deal with blood most cancers therapeutics firm Geron for the most cancers drug Rytelo’s royalties. And, it solid a $350 million royalty settlement with New York-based Syndax Prescribed drugs for the latter’s FDA-approved monoclonal antibody Niktimvo again in November.

Will massive pharma collaborations be forged apart?

Till royalty aggregators got here into the image, massive pharmas have been those seizing licensing alternatives – however in a unique method, because the biotechs licensing out their applied sciences have been entitled to milestone funds. So, does this threaten biopharma licensing collaborations?

Apparently not, in response to a monetary advisor in a report by BioSpace. George Shuster Jr., companion at American regulation agency WilmerHale, defined within the article that massive pharma “has been completely happy to take a backseat and permit different corporations to take a threat within the brief time period,” permitting for extra therapies to get forward in growth. This takes the strain off multinational pharmas to put money into a number of therapeutic candidates.

Nevertheless, as royalty offers sometimes come up at a time of market unpredictability – permitting startups and younger biotechs creating novel applied sciences to rake in cash upfront – whether or not this pattern will final shouldn’t be sure. Nevertheless it appears like they gained’t be disappearing from the scene anytime quickly, and the rising portfolios of royalty aggregators like XOMA Royalty are proof of this.

Oncology R&D traits and breakthrough improvements

Sponsored by Kadans, this report identifies the newest traits and rising applied sciences in oncology R&D.