My view has lengthy been that if the world economic system doesn’t have sufficient vitality sources, it should contract. The state of affairs is analogous to a baker with out sufficient substances to bake the dimensions of cake he desires to make, or a chemist not with the ability to arrange a full-scale mannequin of a response. Maybe, if a plan is made to make a smaller, in another way organized economic system, it may nonetheless work.

The kinds of vitality with insufficient provides are each oil (notably diesel and jet gasoline) and coal. Diesel and jet gasoline are particularly utilized in long-distance transportation and in meals manufacturing. Coal is especially utilized in industrial actions. With out sufficient of those fuels, the world economic system is compelled to make fewer items and providers, and to make them nearer to the tip person. One way or the other the economic system wants to alter.

My evaluation signifies that our expectation of what goes mistaken with insufficient vitality provides is mistaken. Unusually sufficient, it’s the funds of governments that begin to fail, early on. They add an excessive amount of debt to assist investments that don’t pay again properly. They add too many applications that they can’t be supported for the long run. They change into extra keen to quarrel with different international locations. After all, nobody will inform us what is admittedly taking place, partly as a result of politicians themselves don’t perceive.

On this put up, I’ll attempt to clarify a few of the modifications going down because the economic system begins to reorganize and take care of this insufficient vitality provide state of affairs.

[1] One vitality restrict we’re hitting is with respect to “center distillates.” That is the fraction of the oil provide that gives diesel and jet gasoline.

Every kind of vitality provide appears to be most fitted for explicit makes use of. Center distillates are those the economic system makes use of for lengthy distance transport of each people and items. Diesel can be closely utilized in farming. If the world is in need of center distillates, we should determine a approach to make items in a approach that’s nearer to the tip person. We may additionally want to make use of much less fashionable farm tools.

The highest line on Determine 1 signifies that the world economic system has step by step been studying the way to use much less whole oil provide, relative to inhabitants. Earlier than oil costs started to soar in 1973, oil with little refining was burned to provide electrical energy. This oil use could possibly be eradicated by constructing nuclear energy vegetation, or by constructing coal or pure fuel electrical energy technology. House heating was typically achieved by deliveries of diesel to particular person households. Factories typically used diesel as gasoline for processes completed by machines. Many of those duties may simply be transitioned to electrical energy.

After the spike in oil costs in oil costs in 1973, producers began making vehicles smaller and extra gasoline environment friendly. In more moderen years, younger individuals have begun deferring shopping for an car as a result of their value is unaffordable. One other issue holding down oil utilization is the development towards working from dwelling. Electrical automobiles may additionally be having an influence.

On Determine 1, knowledge for crude oil (second line) is offered by October 2024. This knowledge means that crude oil manufacturing has been encountering manufacturing issues lately. Be aware the oval labeled “Crude oil downside,” regarding current manufacturing for this second line. The opposite two traces on Determine 1 are solely by 2023.

The issue inflicting the cutback in oil manufacturing (relative to inhabitants) is the alternative of what most individuals have anticipated: Costs are usually not excessive sufficient for producers to ramp up manufacturing. OPEC, and its associates, have determined to carry manufacturing down as a result of costs are usually not excessive sufficient. The underlying downside is that oil costs are disproportionately affected by what customers can afford.

Meals costs around the globe are critically dependent upon oil costs. The overwhelming majority of consumers of meals, worldwide, are poor individuals. If budgets are stretched, poor individuals will are likely to eat much less meat. Producing meat is inefficient; it requires that animals eat a disproportionate variety of energy, relative to the meals vitality they produce. That is particularly the case for beef. A development towards much less meat consuming, and even consuming much less beef, will have a tendency to carry down the demand for oil.

One other method to holding down meals prices is to purchase much less imported meals. If customers select to eat much less high-priced imported meals, this can have a tendency to make use of much less oil, particularly diesel and jet gasoline. One other factor prospects can do to carry down meals prices is to go to eating places much less. This additionally tends to scale back oil consumption.

On Determine 1, the third line is the one I’m particularly involved about. That is the one which exhibits center distillate (diesel and jet gasoline) consumption. That is the one which was tremendously squeezed down in 2020 by the restrictions associated to Covid. Diesel is the gasoline of heavy trade (development and highway constructing), in addition to lengthy distance transport and agriculture. Electrical energy isn’t a very good substitute for diesel; it can’t give the bursts of energy that diesel supplies.

Shut examination of the third line on Determine 1 exhibits that between about 1993 or 1994 and 2007, the consumption of center distillates was rising relative to world inhabitants. This is smart as a result of worldwide commerce being ramped up, beginning about this time. There was a dip on this line in 2009 due to the Nice Recession, after which center distillates per capita consumption noticeably leveled off. This flattening could possibly be an early pointer to inadequacy within the center distillate oil provide.

In 2019, center distillate consumption per capita first began to stumble, falling 1.4% from its earlier stage. The restrictions in 2020 introduced center distillate consumption per capita down by 18% from the 2019 stage. This was a far better lower than for whole oil (prime line on Determine 1) or crude oil (center line). By 2023 (the most recent level), per capita consumption had solely partially recovered; the extent was nonetheless under the low level in 2009 after the Nice Recession.

Center distillates may be present in virtually any sort of oil, however the very best provide is in very heavy oil. Examples of suppliers of such heavy oil are Russia (Urals), Canada (oil sands), and Venezuela (oil sands in Orinoco belt). The worth for such heavy oil tends to lag behind the value for lighter crude oil due to the excessive value of transporting and processing such oil.

Unusually sufficient, international locations that aren’t getting sufficient funds for his or her exported fossil fuels have a tendency to begin wars. My evaluation suggests that on the time World Struggle I began, the UK was not getting a excessive sufficient value for the coal they have been making an attempt to extract. The coal was getting dearer to extract due to depletion. Germany had an analogous downside on the time World Struggle II began. The monetary stresses of exporters who really feel they’re getting an insufficient value for his or her exported fossil fuels appears to push them towards wars.

We are able to speculate that the monetary pressures of low oil costs have been considerably behind Russia’s resolution to be at struggle with Ukraine. The current issues of Venezuela and Canada may additionally be associated to the low costs of the heavy oil they’re making an attempt to extract and export.

Extracting a better amount of heavy oil would seemingly require greater costs for meals around the globe due to the usage of diesel in rising and transporting meals. Publications displaying oil reserves point out that there’s a enormous quantity of heavy oil within the floor around the globe; the issue is that it’s unimaginable to get the value up excessive sufficient to extract this oil.

The existence of those heavy oil “reserves” is without doubt one of the issues that makes many modelers suppose that our largest downside sooner or later may be local weather change. The catch is that we have to get the oil out at a value that buyers of meals and different items can afford.

[2] One other vitality restrict we’re hitting is coal.

Coal vitality is the inspiration of the world’s trade. It’s particularly utilized in producing metal and concrete. Coal began the world industrial revolution. The first benefit it has traditionally had, is that it has been cheap to extract. It’s also pretty straightforward to retailer and transport. Coal may be utilized with out an enormous quantity of specialised or complicated infrastructure.

China produces and consumes greater than half of the world’s coal. In recent times, it has been far above different international locations in industrialization.

World coal consumption per capita has been falling since about 2011. Arguably, world coal consumption was on a bumpy plateau till 2013, with world coal consumption per capita really falling solely throughout 2014 and thereafter.

This sample of coal utilization implies that world industrialization has been constricted, particularly since 2014. In reality, the restriction began as early as 2012. It turned unimaginable for China to construct as many new condominium residence buildings as inexpensively as promised; this finally led to defaults by builders. World metal output began to change into restricted. The mannequin of world financial progress, led by China and different rising markets, started to vanish.

The issue coal appears to have is similar as the issue diesel has. There’s a enormous amount of coal sources accessible, however the value by no means appears to rise excessive sufficient for lengthy sufficient for producers to really ramp up manufacturing, particularly relative to the ever-growing world inhabitants. Coal is particularly wanted now, with intermittent wind and photo voltaic leaving massive gaps in electrical energy technology that must be crammed by burning some fossil gasoline. Coal is far simpler to ship and retailer than pure fuel. Oil is handy for electrical energy balancing, nevertheless it tends to be high-priced.

[3] Political leaders created new narratives that hid the issues of insufficient middle-distillate and coal provides.

The very last thing we will count on a politician to inform his constituents is, “Now we have a scarcity downside right here. There are extra sources accessible, however they’re too costly to extract and ship to offer inexpensive meals, electrical energy, and housing.”

As a substitute, political leaders in all places created new narratives and began to encourage investments following these new narratives. To encourage funding, they lowered rates of interest (Determine 4), made debt very accessible, and supplied subsidies. Governments even added to their very own debt to assist their would-be options to vitality issues.

Political leaders developed very plausible narratives. These narratives have been much like Aesop’s Fable’s “Bitter Grapes” story, claiming that the grapes have been actually bitter, so the wolf didn’t really need the grapes he initially sought.

The favored narrative has been, “We don’t really need coal or heavy kinds of oil anyhow. They’re terribly polluting. Moreover, burning fossil fuels will result in local weather change. There are new cleaner types of vitality. We are able to additionally stimulate the economic system by including extra applications, together with extra subsidies to assist poor individuals.”

This narrative was supported by politicians in most energy-deficient international locations. The rise in debt following this narrative appeared to maintain the world economic system away from one other main recession after 2008. Individuals started to consider that it was debt-based applications, particularly these enabled by extra US authorities spending, that pulled the economic system ahead.

They didn’t perceive including debt provides extra “demand” for items and providers usually, and the vitality merchandise wanted to make them. Nevertheless, it doesn’t obtain the specified outcome if inexpensively accessible vitality sources are usually not accessible to satisfy this demand. As a substitute, the pull of this demand will partly result in inflation. That is the difficulty the economic system has been up towards.

[4] What may presumably go mistaken?

There are a variety of issues which have began to go mistaken.

(a) US governmental debt is skyrocketing to an unheard-of stage. Relative to GDP, the US Congressional Funds Workplace (CBO) tasks that US debt will quickly be greater than it was on the time of World Struggle II.

Discover that the most recent surge in US authorities debt began in 2008, when the Federal Reserve determined to bail out the economic system with ultra-low rates of interest (Determine 4). A second surge happened in 2020, when the US authorities started extra give-away applications to assist the economic system as Covid restrictions happened. The CBO forecasts that this surge in debt will proceed sooner or later.

(b) Curiosity on US authorities debt has change into an enormous burden. We appear to want to extend authorities debt, merely to pay the ever-higher curiosity funds. That is half of what’s driving the elevated debt projected within the 2025 to 2035 interval.

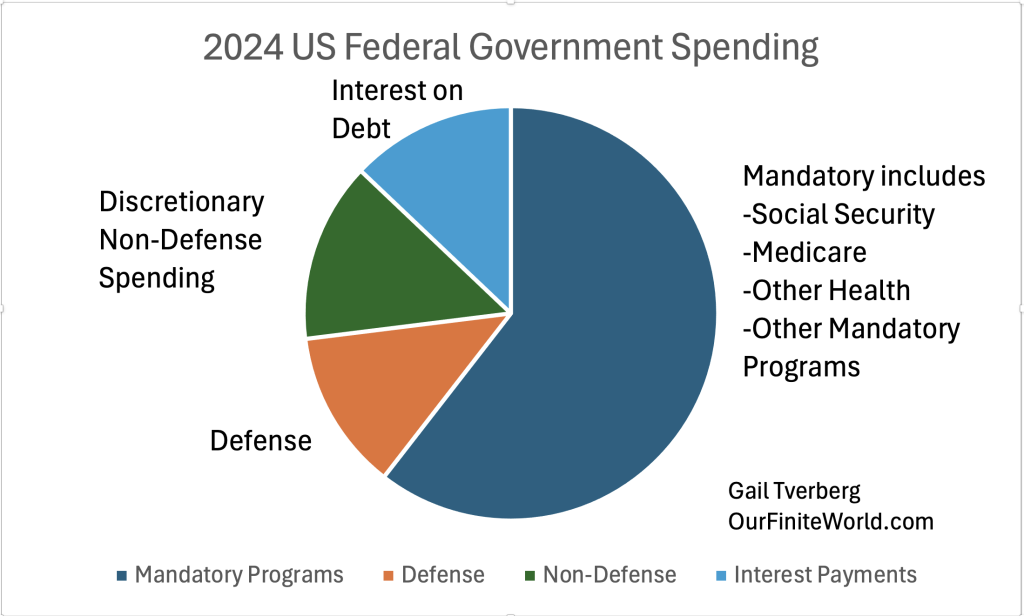

Determine 6 exhibits a breakdown of precise Fiscal 12 months 2024 US Federal Authorities spending by main classes.

Be aware that US authorities spending on curiosity funds ($881 billion) is now bigger than protection funds ($855 billion). A part of the issue is that the ultra-low rates of interest of the 2008 to 2022 interval have turned out to be unsustainable. (See Determine 4.) As older debt at decrease rates of interest is step by step changed by more moderen debt at greater charges, it appears seemingly that these curiosity funds will proceed to develop sooner or later.

(c) Continued deficit spending seems more likely to be wanted sooner or later.

The CBO estimates in Determine 5 appear more likely to be optimistic. In January 2025, the CBO anticipated that inflation would instantly lower to 2% and keep at that stage. The CBO additionally expects the first deficit to fall.

(d) The shortfall in tax {dollars} can’t simply be fastened.

Right this moment, tax {dollars} principally come from American taxpayers, both as earnings taxes or as payroll taxes.

An individual can deduce that to cease including to the deficit, extra taxes of at the very least 5% or 6% of GDP (which is equal to 12% to 14% of wages) could be wanted. Doubling payroll taxes may present sufficient, however that can’t occur.

Company earnings taxes collected lately have been very low. US corporations are both not very worthwhile, or they’re utilizing worldwide tax legal guidelines to offer low tax funds.

(e) The extremely low rates of interest have inspired every kind of funding in tasks that will make individuals joyful, however that don’t truly end in extra items and providers, or extra taxable earnings.

Determine 8 exhibits that US company earnings taxes have been falling over time. The reason being not totally clear, however it might be that corporations set their sights decrease when the return that’s required to pay again debt with curiosity is low. All of the subsidies for wind, photo voltaic, electrical automobiles, and semiconductor chips have targeted the curiosity of companies on units that will or is probably not producing an enormous quantity of taxable earnings sooner or later.

I’ve written articles and given talks corresponding to, Inexperienced Vitality Should Generate Ample Taxable Earnings to Be Sustainable. Inexperienced vitality can appear to be it might work if an individual makes use of a mannequin with an rate of interest close to zero, and insurance policies that give renewable electrical energy artificially excessive costs when it’s accessible. The issue is that, a method or one other, the system as an entire nonetheless must generate sufficient taxable earnings to maintain the federal government working.

After all, most of the investments with the extra debt have been in non-energy tasks. There have been do-good tasks around the globe. Younger individuals have been inspired to go to school utilizing debt repayable to the federal government. Authorities funding has supported healthcare and pensions for the aged. However do these many applications really result in greater tax {dollars} to assist the US authorities? If the economic system really have been very wealthy (a number of cheap surplus vitality), it may afford all these applications. Sadly, it’s turning into clear that the US has extra applications than it might afford.

(f) The ultra-low rates of interest have inspired asset value bubbles and wealth disparities.

With ultra-low rates of interest and available debt, property costs are likely to rise. Buyers resolve to purchase houses and “flip” them. Or they purchase them, and plan to lease them out, hopefully earning profits on value appreciation.

Inventory market costs are additionally buoyed by the available debt and low rate of interest. The US S&P 500 inventory market has offered an annualized return of 10.7% per yr since 2008, whereas Worldwide Markets (as measured by the MSCI EAFE index) have proven a 3.3% annual return for a similar interval, based on Morningstar. The large improve in US authorities debt little doubt contributed to the favorable S&P 500 return throughout this era.

Wealth disparities are likely to rise in an ultra-low curiosity interval as a result of the wealthy disproportionately are usually asset house owners. They’re those who use “leverage” to get much more wealth from rising asset costs.

(g) Tensions have risen around the globe, each between international locations and amongst particular person residents.

The underlying downside is that the system as an entire is below nice pressure. Some components of the system should get “shorted” if there’s not sufficient coal and sure kinds of oil to go round. Politicians sense that China and the US can’t each succeed at industrialization. There’s too little coal, for one factor. China is struggling; very often it appears to be making an attempt to attempt to “dump” items on the world market utilizing backed costs. This makes it much more troublesome for the US to compete.

Particular person US residents are sometimes sad. With the bubble in dwelling costs and at this time’s rates of interest, residents who are usually not now owners really feel like they’re locked out of dwelling possession. Inflation in the price of lease, cars, and insurance coverage has change into an enormous downside. Individuals who work at unskilled hourly jobs discover that their way of life is usually not a lot (or any) greater than individuals who select to stay on authorities advantages quite than work. Pretty radical leaders are voted into energy.

[5] The main underlying downside is that it actually takes a rising provide of low-priced vitality merchandise to propel the economic system ahead.

When loads of cheap-to-extract oil and coal can be found, rising authorities debt can assist to encourage their growth by including to “demand” and elevating the costs customers can afford to pay. Excessive costs of oil and coal change into much less of an issue for customers.

However when vitality provide of the required varieties is constrained, the extra shopping for energy made accessible by added debt tends to result in inflation quite than extra completed items and providers. This inflationary tendency is the issue the US has been contending with lately.

Unusually sufficient, I believe that rising cheap coal provide supported the world economic system, as oil costs rose to a peak in 2011. As China industrialized its economic system utilizing coal, its demand for oil rose greater. The upper world demand coming from this industrialization helped to lift oil costs. However as coal provide (relative to world inhabitants) started to fall, oil costs additionally started to fall. By 2014, the decline in industrial manufacturing attributable to the decrease coal provide (Determine 3) seemingly contributed to the autumn in oil costs proven on Determine 9.

It’s the truth that oil costs haven’t been capable of rise greater and better, even with added authorities debt, which is inhibiting oil manufacturing. World coal manufacturing is inhibited by an analogous issue.

[6] The world economic system appears to be headed for a significant reorganization.

The world economic system appears to be headed within the path that many, many economies have encountered prior to now: Collapse. Collapse appears to happen over a interval of years. The present economic system is more likely to lose complexity over time. For instance, with insufficient center distillates, long-distance delivery and journey will must be scaled approach again. Buying and selling patterns might want to change.

Governments are among the many most weak components of economies as a result of they function on accessible vitality surpluses. The collapse of the Central Authorities of the Soviet Union happened in 1991, leaving in place extra native governments. One thing like this might occur once more, elsewhere.

I count on that complicated vitality merchandise will step by step fail. Gathering biomass to burn is, in some sense, the least complicated type of supplemental vitality. Oil and coal, at the very least traditionally, haven’t been too far behind, when it comes to low complexity. Different types of at this time’s human-produced vitality provide, together with electrical energy transmitted over transmission traces, are extra complicated. I’d not be shocked if the extra complicated types of vitality begin to fail, at the very least in some components of the world, pretty quickly.

Donald Trump and the Division of Authorities Effectivity appear to be a part of the (sadly) crucial downshift within the dimension of the economic system. As terrible as could also be, one thing of this type appears to be crucial, if the US authorities (and governments elsewhere) have tremendously overpromised on what items and providers they will present sooner or later.

The self-organizing economic system appears to make modifications by itself based mostly on useful resource availability and different elements. The state of affairs is similar to the evolution of vegetation and animals and the survival of the very best tailored. I consider that there’s a God behind no matter modifications happen, however I do know that many others will disagree with me. In any occasion, these modifications can’t happen merely due to the concepts of a specific chief, or group of leaders. There’s a physics downside underlying the modifications we’re experiencing.

There’s a nice deal extra that may be written on this topic, however I’ll go away these ideas for one more put up.